The crude oil recovery

US petroleum product data shows that diesel and gasoline consumption is recovering strongly. Back in May, we had flagged the potential for a bonanza summer travel season that could boost oil demand. This is kicking in.

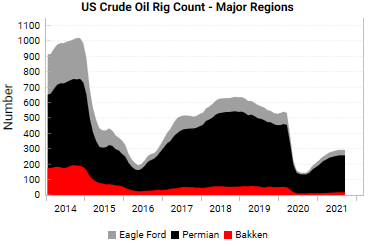

US production also remains contained despite surging oil prices. US shale producers acting more rationally will also give OPEC+ less reason to flood the market to defend their market share.

We see the need to become increasingly selective in which part of the oil & gas industry to remain invested. The rise in oil prices is mainly being driven by on-going supply constraints against a backdrop of recovering demand.

Restrained production activity means that oil field services may see a slower earnings recovery than implied by the rise in oil prices, while E&P companies could be set to benefit from a period of elevated oil prices, increasing the value of their reserves. We are starting to see this in the rising gap between E&P vs oil services equity performance. The XOP (E&P ETF) has outperformed OIH (OFS ETF) off the lows.

Get the full picture at variantperception.com.