US economic outperformance supports USD rally

We continue to expect US economic outperformance in the coming months, which should attract capital towards the US, boosting the USD. Although US PMIs are no longer elevated vs the rest of DM, the previous surge has yet to play out, and offers a long 12 month lead on the USD, which still points to the potential for a USD rally. US M1 growth has been extremely strong vs the rest of the world, which has historically led to US economic outperformance and a stronger USD.

USD positioning is more neutral vs 2 months ago, but this is not yet a headwind for a further USD rally.

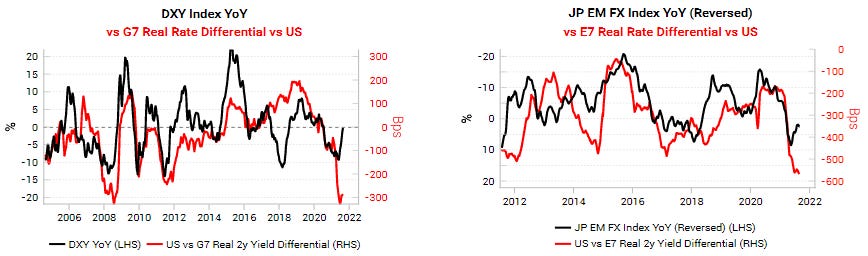

The main bear thesis for the USD is that real rate differentials are exceedingly low in the US, but they are already at multi-year lows and will struggle to get more negative. Real rate differentials are more likely to mean-revert higher as policy divergences peak, removing a major headwind for the USD.

Get the full picture at variantperception.com.