Gold divergences

Gold has been diverging from macro and market data. Our macro-driven gold price indicator (a fair value forecast based on macro inputs like the DXY, yields and CPI) has jumped as higher inflation overcomes the negative impact of the strong USD.

Gold is also coming into the seasonally more positive period of the end of Q4 and into Q1. ETF flow data shows some decent outflows already, with nearly 40% of the cumulative inflows into gold ETFs since 2019 coming back out of the market since October 2020.

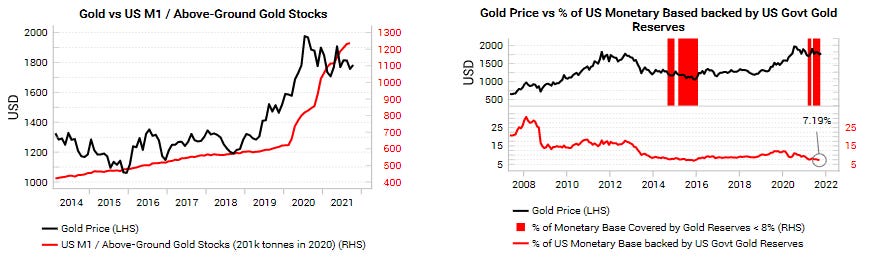

The structural bull case for gold remains valid as nominal money supply continues to grow while above-ground gold stocks remain limited in supply. The percentage of the US monetary base covered by US government gold reserves also remains very low.

Get the full picture at variantperception.com.