Global savings glut: structural headwinds for yields

Google trend searches for “savings glut” shows the surge of interest in the 2000s and waning interest ever since (left chart below). This is matched by the peaking of global imbalances during the GFC and the subsequent fall (right chart below). We track the magnitude of global imbalances by summing up the absolute value of all current account balances (surplus & deficit) globally as a % of global GDP.

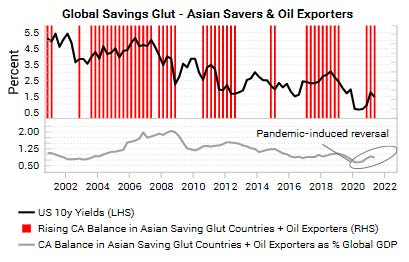

In the wake of the pandemic, there are reasons to believe that the global savings glut theme could be about to return. The pandemic disruption to supply chains and the subsequent surge in commodity prices are both contributing to improving current account balances among the east Asian exporters (traditionally also large savers), as well as the improvement in current account balances among oil exporters.

Rising current account balances among Asian savers and oil exporters are associated with periods of falling US yields. As a structural theme, this is worth tracking for the long-term context in thinking about cyclical asset allocation decisions. The return of the global savings glut could act as a ceiling on how high DM yields can rise.

Get the full picture at variantperception.com.