Inflation panic overdone

Last month's US inflation print of 7.5% made headlines even among the non-financial press, and caused money markets to overshoot in pricing an even more hawkish Fed (~6.5 hikes in 2022). The panicked hawkish market response to the inflation print is understandable as the breadth of inflation has widened, with the majority of CPI components rising at 5%+ yoy (left chart below). The extremely hawkish messaging from St. Louis Fed president Bullard also helped to catalyze market moves, allowing spot 10y yields to rise above 2.00%. However, inflation surprises are rolling over (right chart below) and we see room for the Fed to err dovishly heading into 2H22 once the inflation data peaks.

Our Inflation LEIs continue to show US inflation peaking and rolling over from March/April. China’s PPI has also peaked and base effects will kick in from March.

The ISM prices paid survey has also rolled over and food PPI looks to have peaked, which will help to relieve the pressure on food prices in 2H22.

VP’s Common Inflation Expectations (CIE) index has also rolled over (left chart below) and done a very good job of forecasting the moves in the Fed CIE index (which is released with a lag). It is interesting to note the large divergence between our CIE and the US term premium (right chart below).

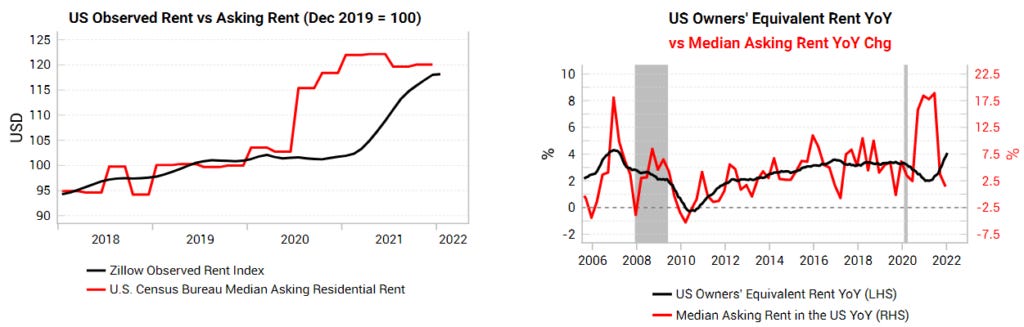

Housing is one of the largest CPI components and has driven inflation upside in recent months.

Housing’s contribution to inflation will remain meaningful, but should mean-revert lower from the extreme yoy changes we see at present. The housing data has been affected by eviction moratoriums during the pandemic and inherent delays in data collection when computing the CPI numbers. These distortions will come out of the data in the coming 3-6 months.The left chart below shows the previous divergence between asking rents and observed rents during the pandemic (thanks to eviction moratoriums), which has now closed. This catch up has driven the delayed surge in shelter CPI.