2026 Outlook

Weekly Wrap, Dec 12, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Part 3: Country-specific drivers to matter more in 2026 (Dec 11)

Global: Cyclical tailwinds still intact for 1H26, still supports EM over DM

DM

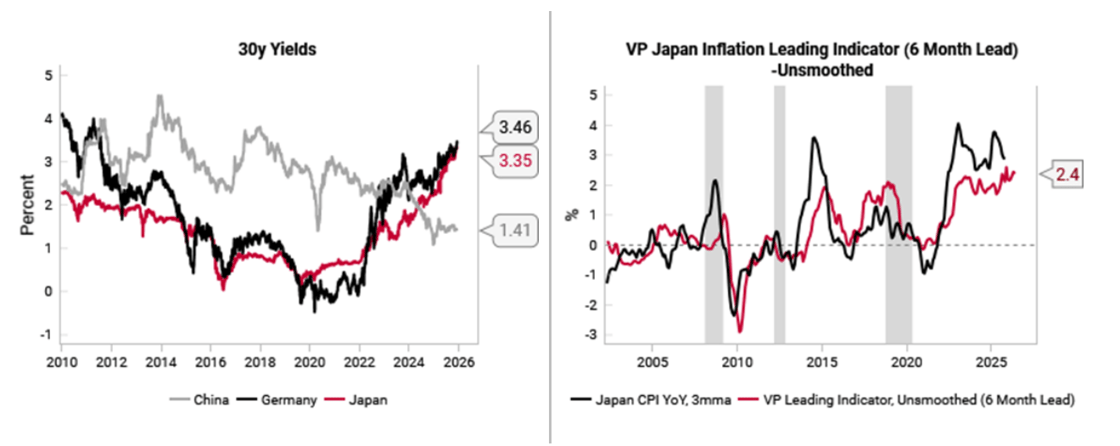

Japan Resolving the impossible trinity problem means JPY can finally rally in 2026

UK Growth LEIs yet to bottom, necessary to support domestic equity rally

Canada Steady growth and inflation LEIs, 10y bond short (yield up) playing out

Australia Accelerating nominal growth, stay long AUD vs short EUR

EM

Brazil Disinflation the key macro driver, stick with riskparity, add on election volatility

Mexico Growth downside risks, USMCA renegotiation looms

Indonesia IDR and equities have catch up potential in 2026 as headwinds fade

South Africa Broad tailwinds from easing cycle, low energy prices, high metals price

Part 2: A US-China world, and Europe is just living in it (Dec 8)

US

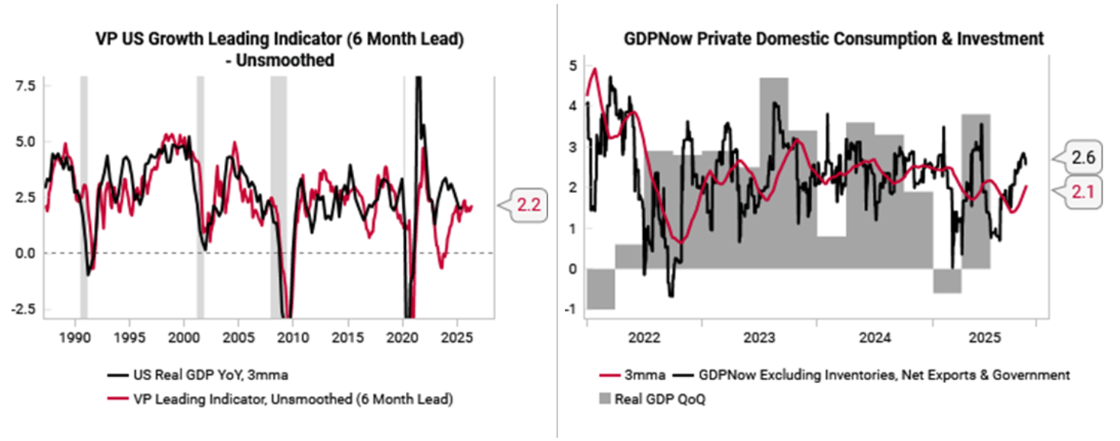

Growth: Steady, potential for upside surprise

Labor: Labor market softening, ’02-’03 “jobless growth” remains the template

Inflation: Soft labor + falling inflation => dovish Fed bias in 2026

Consumer: Still bifurcated but steady in aggregate

Capex: Tailwinds aligned for capex-driven upside surprise

China

Growth: Growth outlook remains weak as structural headwinds strengthen

Inflation: “Anti-involution” efforts helping at the margin, but disinflation persists

Assets: Not yet time to look for CNH strength, buy dips in Chinese tech stocks

Eurozone

Growth: Structural headwinds outweigh cyclical rebound as global pressures mount

Inflation: Inflation outlook mixed, disinflation will be gradual

Assets: Weaker EUR remains the release valve to maintain export competitiveness

Part 1: The appropriate amount of greed (Dec 2)

2025 Recap: Everything Everywhere All at Once in 2025

Cyclical Asset Allocation: Macro Risk Indicator remains in “risk-on” territory

Leading Indicators: LEIs paint a picture of resilient growth and inflation rolling over

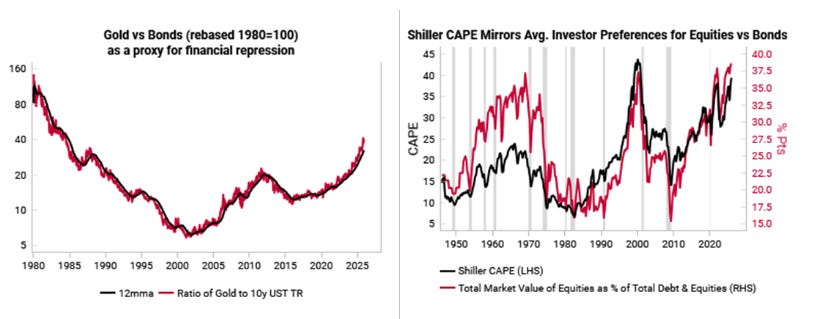

Structural Asset Allocation: Financial repression, high valuations, changing profit drivers, high real yields

Volatility: Don’t forget to look for opportunistic long vol hedge.

#1 Trump’s capex boom arrives a year late, broadens beyond AI

#2 US growth surprises to the upside despite muted labor market

#3 Housing disinflation breaks sticky inflation narratives

#4 US 10y yields go nowhere, trades in a tight range around 4%

#5 Value equities outperform growth

#6 G10 FX divergence: Apac (AUD & NZD) over Europe (EUR & GBP)

#7 EM equities outperform DM, led by Brazil

#8 Oil trades below 50 and above 75 at some point during the year

#9 China tech stocks outperform US tech stocks

#10 Capital Cycle: US regional banks & energy services outperform