A Whiff of Reflation

Weekly Wrap, Oct 10, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Research

A whiff of reflation - Oct. G3 Leading Indicator Watch

Our cyclical roadmap: Fed has eased monetary policy into a backdrop of elevated nominal GDP. Recession is unlikely if financial conditions are loose and savings rates are falling.

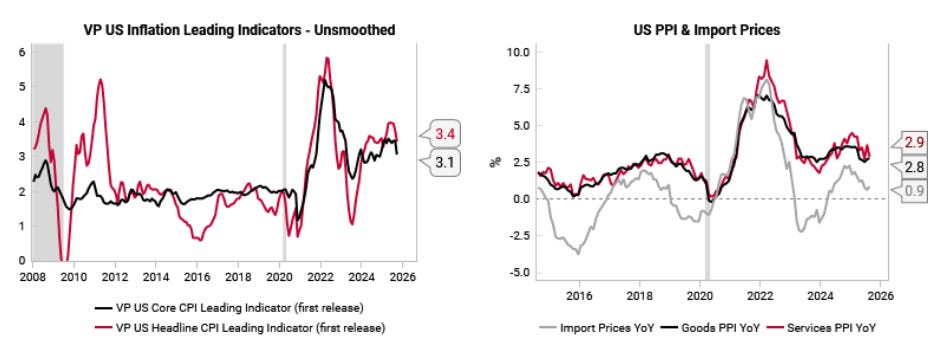

US Inflation: Moderate inflation pressures

US Consumer/Manufacturing: Signs of relief + potential for an inventory re-build cycle

US Recession Risks: Recession unlikely if everyone dis-saves and financial conditions loose

US Growth: 2002-03 analog in muted jobs market alongside resilient growth

US Growth: Resilient leading indicators alongside resilient coincident growth

China: Excess liquidity tailwinds, waiting for more housing/consumer stimulus

China: Rebound continues for growth and inflation leading indicators

Eurozone: Consensus too optimistic on disinflation

Eurozone: Leading indicator improvement broadening, but structural issues remain

Opportunistic long VIX to hedge risk asset exposures

The old saying in risk management: buy protection when you can, not when you have to.

We’ve been intentionally opportunistic in flagging when the volatility market presents attractive risk-reward opportunities to add long vol exposure. Today, our indicators once again signal a favorable tactical setup to go long volatility.

Our tactical “complacency” signal has triggered again for US equities. US single-stock implied volatility is now very elevated relative to the S&P index volatility.

Global Macro Update: Fed cut roadmap playing out, adjusting our top ideas

Our “buy the rumor, sell the fact” playbook around the September Fed meeting is playing out, where the Fed cut marks a tradeable low in yields and the USD while ultimately supporting further equity gains.

In the very short-term, we like adding tactical long VIX position amid signs of complacency. In light of this, and given some big price moves over the past week, we are narrowing our focus:

Take profit on long CADJPY

Take profit on Long INDA

Close flat PnL on short CNHINR

Change UK rates recession trade