Be selective as EM hiking cycles end

EM countries have hiked earlier and faster than DM countries, keeping a lid on domestic inflation and allowing a select few EM central banks to end their hiking cycles. We advised VP clients to be selective in EM, with Brazil local sovereign debt offering safe harbor. The below is an excerpt from our Aug 18th report to clients.

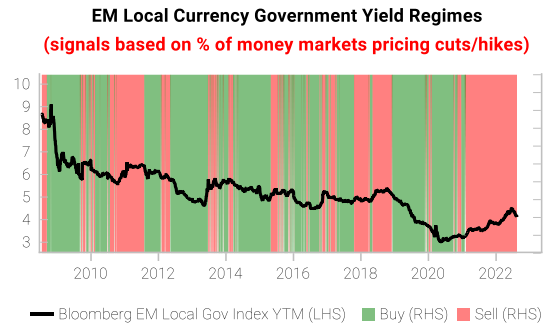

Money markets tell us that it is not a good time to overweight EM local government bonds in aggregate. When 6-month forward rates are falling, it usually precedes a sustained fall in local government bond yields.

Hiking cycles are ending in some parts of LatAm and CE3, but it is only in Brazil where money markets are starting to price in cuts: we still like buying Brazil local government debt. The best time to buy local currency government debt is when central banks are priced to cut, real yields are high and inflation is peaking.

Our Brazil LEI remains at a low level. The external environment is still poor and the surge in SELIC rate will continue to weigh down our LEI.

Inflation has finally converged with our inflation model. The strength of the BRL has been a major contributor to the decline in our model. M1 growth has also declined significantly through the hiking cycle.

DMs are paying the price for their lagged tightening cycle, DM CPI has surged beyond that in EM.

Higher real rates in EM give their central banks more room to start cutting, allowing them to be responsive to falling inflation and deteriorating growth.

Our liquidity-regime indicator still avoids overweighting EM equities and this is unlikely to change very soon. Conditions to turn bullish on a 6-month+ basis: 1) positive global excess liquidity (far away), 2) EM real M1 growth outpacing DM (close), 3) VP China LEI upturn (not close).

Get the full picture at variantperception.com