Betting on a De-sync - Excerpt from VP December G3 Leading Indicator Watch

US exceptionalism consensus creates downside risks. The US consumer looks like a paper tiger, while labor hoarding + distorted inventory cycle are further masking underlying vulnerabilities.

This post is an excerpt from our Dec 8th, 2023 report to VP clients (link to original report), digging into themes across the US, China, and Eurozone.

US Consumer may be a paper tiger

The soft landing thesis is based on US consumer exceptionalism. As laid out in our themes part 1, we suspect the US consumer is still spending as they are not worried about jobs (labor hoarding), but personal finances are getting worse.

There is a notable divergence between the much weaker University of Michigan consumer survey (larger weighting towards personal finance questions) vs the Conference Board survey (larger weighting towards jobs).

This is corroborated by our consumer pressure proxy showing headwinds. Rent and medical expenses are not discretionary, while rising credit card balances indicate financial safety nets already being used up.

Labor hoarding post-Covid has kept the labor market tight, giving consumers a false sense of job security. As labor and financing costs keep rising, profit margin erosion will become too painful, forcing more layoffs.

There is a big divergence between our US leading indicator, which is recovering, and the conference board version, which is much more negative. We suspect the truth is something in between.

Our leading indicator has been driven by the rise in the ISM manufacturing new orders to inventory ratio, but this has NOT been confirmed by the headline ISM. We also suspect Covid has distorted the inventory cycle, meaning a longer wait for inventories to clear downstream.

Labor market slowdown gradual at first, then sudden

The soft landing thesis is based on labor resilience being a sign of strength. We think labor market tightness is due to labor hoarding, creating downside risks as labor fights back to restore REAL INCOME LEVELS (i.e. wage growth in excess of inflation).

As highlighted in our Godot’s Recession thesis, a fall in profit margins typically precedes a rise in unemployment rates. However, the prevalent high rate of labor hoarding is delaying the typical lead-lags. We are still in the transition period, resulting in lots of divergent labor market data.

Initial claims remain secularly suppressed, even though the >30% rise from the lows earlier this year has preceded every recession in history.

Continuous claims have risen by over 20% YoY in ~40 states, which is usually only seen in recessions. Laid-off workers are struggling to find new jobs quickly.

Nonfarm payrolls are still growing, inline with historical soft landings, but job openings have dropped substantially from the peak, which is typically only seen in recessions.

Labor market cracks are forming (slowly), but as highlighted in our 1969-70 roadmap, we suspect a gradual then sudden deterioration. Ernest Hemingway famously wrote: “How did you go bankrupt? Two ways. Gradually, then suddenly”.

Disinflation ≠ Fed cut

The soft landing thesis is based on US disinflation. Our US inflation leading indicators agree. However, our base case remains the Fed will only cut on bad growth data (1969-70 roadmap).

Our Fed Regime Indicator is now in the easing regime, indicating that today’s economic and market conditions are historically associated with rate cuts. However, this is priced into fed fund futures already with almost 5 cuts by 2024 year end.

The Fed still has an incentive to keep markets guessing on hikes over the next 2-4 meetings, to give some extra policy room based on the resilience of coincident data on consumer and labor, as well as fiscal largesse.

Higher yields take time to work their way through the economy and it is not uncommon for a 2 year lag. The proxy Fed Funds rate (which incorporates QT) has often led net interest payments as a % of corporate profits by 2 years. This is a long delay, but the effect does manifest.

The US fiscal impulse is weakening, reducing one of the offsetting factors against Fed tightening. If we are right that the Fed errs on the side of cutting later, the first Fed cut will be bearish for risk assets as the Fed will be very behind the curve by the time the labor markets break.

Credit headwinds persist

The headwinds from the credit cycle are still building. The US prime rate is at 8.5% and interest coverage ratios are deteriorating.

The Fed loan officer surveys are rebounding from very bad levels, but there is usually a lag for the effects to feed through into the coincident data. We would NOT be getting too excited on this turning point yet.

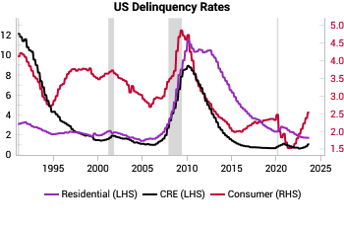

US residential loans remains insulated from credit headwinds given that most homeowners have locked in lower rates and the labor market has been tight due to labor hoarding. But consumer loan delinquencies are now picking up, as is CRE delinquencies.

For more insights into our investment framework, visit our website.