China Leading Indicator Watch

This post is an excerpt from the China section of our November 7, 2024 G3 Leading Indicator Watch report to VP clients. The full length, original report can be viewed here. To gain access to more of our research, contact us here.

Tactically buy equity dips… bull market is policy

Chinese policy is unambiguous in trying to engineer an equity bull market, irrespective of the fundamental conditions. We like tactically buying dips in Chinese equities and approaching China from the long side.

The overnight NPC meeting is widely expected to show more fiscal stimulus measures with consensus expecting around 2 trn RMB stimulus and very forceful backstops to support local government debt (6-10 trn RMB to resolve local government debt).

Even if the announcement disappoints, we would still look to buy dips. The PBOC and the Chinese premier appear resolute in their approach, laying the groundwork to enable more easing announcements over the rest of the year to drive equity markets higher.

The PBOC lending facilities to support equity purchases are in motion and there is much anticipation and rumors of “the national team” buying equities and supporting A-shares.

There has not been enough new data to turn our China growth or inflation leading indicators which both remain at the lows.

However, there are pockets of early improvement in some data. Housing transaction volumes are jumping off the lows…

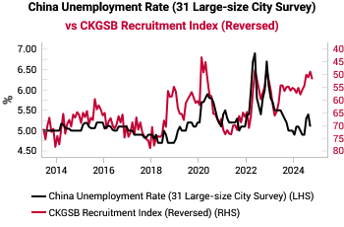

…while employment sentiment is starting to recover (red line starting to fall in below chart).

Reading the tea leaves => stick with long USDCNH

Money market stress, surging HK imports, panda bond issuance and more outflows via the Stock Connect all corroborate the core macro thesis to bet on a higher USDCNH.

After the early October equity surge, our China money market stress signal activated, indicating some bond trading liquidity / collateral issue in Chinese fixed income markets. This money market stress may be why fiscal stimulus (and announcement of more bond issuance) has been slow.

Chinese imports from HK also surged last month. Historically such a surge has been a harbinger of imminent currency depreciation (i.e. higher USDCNH) as the HK trade channel is normally the easiest way for onshore participants to move money quickly.

This higher USDCNH view is also corroborated by a pick up in Panda bond issuance (RMB-denominated onshore bonds from non-Chinese issuers).

The real-time flow of Panda bond deals is controlled informally, providing an indication of the authorities' comfort with the exchange rate and outflows. Allowing more issuance indicates a willingness to allow offshore entities to move money offshore.

Finally, the net northbound (buying onshore shares) vs southbound (buying HK shares) equity flows confirm that onshore sentiment is still biased towards moving funds offshore.

To read more of our research, contact us here.