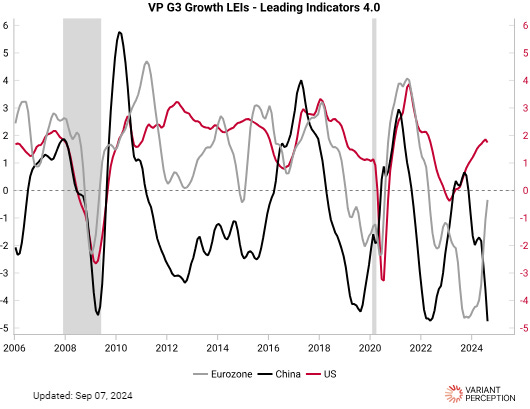

China LEI making new lows, US and EZ LEIs still holding up

This post is an excerpt from our September 6, 2024 G3 Leading Indicator Watch report to VP clients. The full length, original report can be viewed here.

The G3 divergence persists, with our China growth and inflation leading indicators making new lows again this month, while the US and Eurozone are still holding up (below 2 charts).

The overall message is that global growth is sideways and is neither a big positive nor a big negative right now.

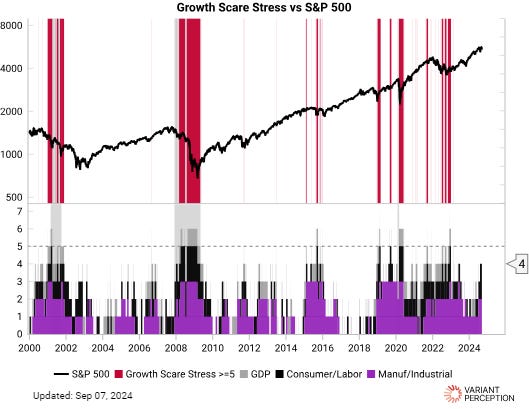

Non-Farm Payrolls have been below 150k for 3 months in a row (given revisions) which has caused our “growth scare” checklist to tick up to 4 out of 9. This means the market will remain on edge as it waits to see if the Fed is behind the curve on growth (we think the Fed cuts are just in time as implied by our macro regime).

For overall context, our macro regime model (ties together growth, inflation, policy and liquidity) is currently neutral, with policy propping up the regime (also see our Macro Snapshot).

The chasm in the relative pricing of equities vs bonds remains the most actionable item in the current macro outlook. Equities and HY are priced for growth, while bonds are priced for recession.

This implies cash is relatively attractive vs both stocks and bonds at present. It also makes sense to hedge against a HY spread widening.

Our G3 Leading Indicator Watch report from this Friday dives deeper into these themes and more across the US, China, and Eurozone. To read the report, contact us here.