China - Tradeable bazooka, not yet a real bazooka

This post was originally shared this past Tuesday morning, September 24 with VP clients. The full length, original report can be viewed here.

Summary

The loud and attention-grabbing nature of the PBOC policy surprise hints that the senior levels of the Chinese government have likely recognized the urgency of the need to act. We think this is a tradeable equity rally worth chasing over the next 1-3 months.

However, the easing measures do not address China's fundamental problems. There are two missing ingredients for a sustained economic rebound.

First, private sector sentiment remains very weak given that there is a political/geopolitical component to the lack of animal spirits (not just an economic component).

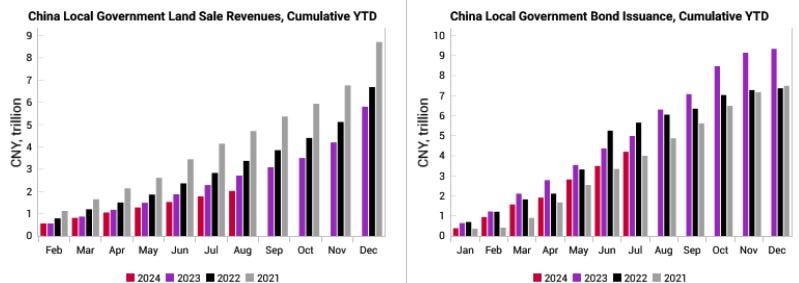

Secondly, land sale revenue - the lifeblood for local governments - have fallen rapidly for the past 3 years and are yet to recover.

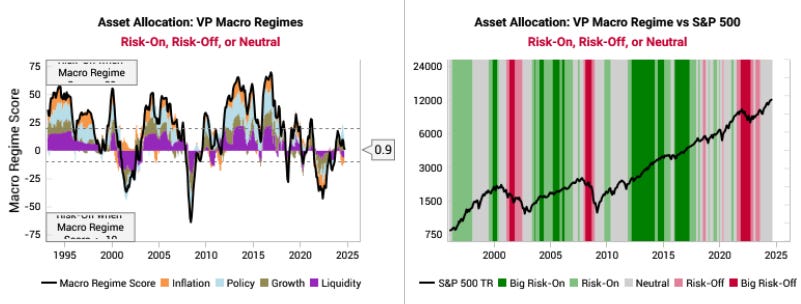

In terms of global implications, this does not change our macro regime, which remains neutral (i.e. neither risk-on, nor risk-off). PBOC policy is one of the components already captured in the policy regime.

Trading market, not an investing market

The PBOC announced a slew of easing measures overnight with many fairly direct equity market interventions (link). We think this is a tradeable equity rally worth chasing over the next 1-3 months, but the easing measures do not address China's fundamental problems.

The loud and attention-grabbing nature of the PBOC policy surprise hints that the senior levels of the Chinese government have likely recognized the urgency of the need to act. This will help to shift the market narrative momentum towards “more stimulus” and much more anticipation of fiscal stimulus.

The short-term trading implication

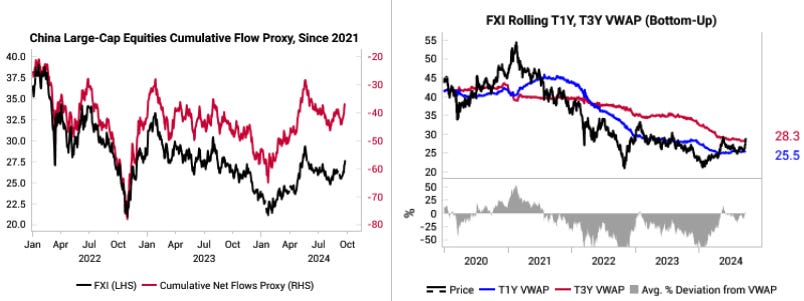

We think there is upside to Chinese equities (e.g. using FXI). Two reliable tactical indicators on China are cumulative flow and bottom-up VWAPs that we use to set stop-loss and target levels.

The 2023 FXI highs above 32 is a good target for the rally. Recent Chinese equities rallies have been short squeezes and tend to run out of momentum when the cumulative flow have reached previous peaks. We will be tracking this closely for signs to get out of the long China trade.

FXI also looks set to rally above the T3Y VWAP level at 28.3. The T3Y VWAP has been a persistent overhead resistance and now that we have broken through becomes a natural support level. We would set stops at around 28.

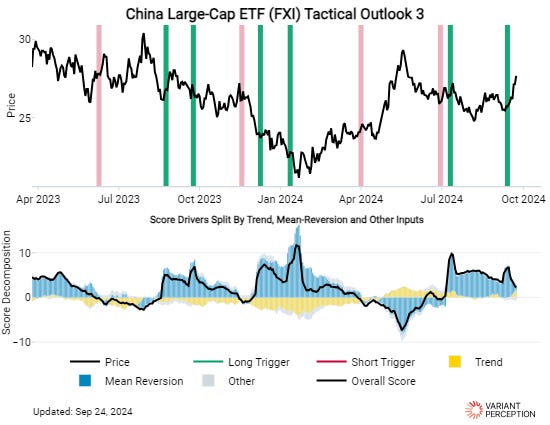

Our Tactical Outlook 3 models also still retain a positive 1-month forward return forecast on FXI.

The easing was largely discounted into bond markets already. Meanwhile, we do not think the macro depreciation pressures on the RMB will be alleviated until China's fundamental economic problems and lack of private sector animal spirits are addressed.

The domestic China implication

The jury is out on if these measures will work beyond boosting equity prices. For now we are skeptical.

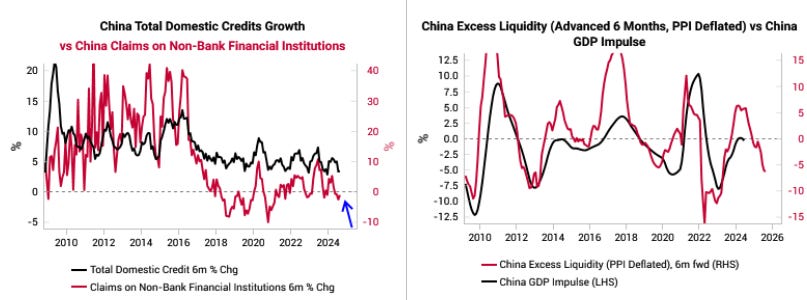

Key measures of Chinese liquidity have been awful and will take time to correct. Our shadow finance proxy (Non-bank financial institution balance sheet growth) has been stagnant. Chinese excess liquidity had also already turned negative.

There are two missing ingredients for a sustained economic rebound.

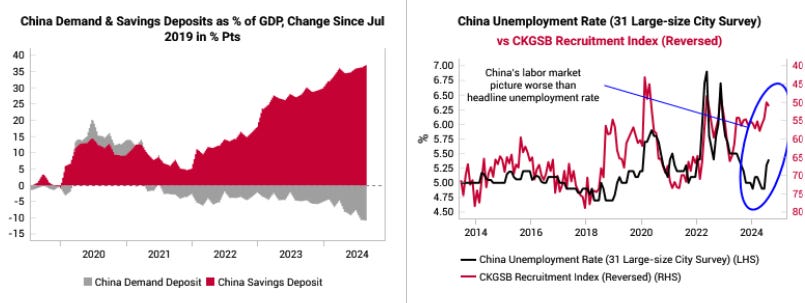

First, private sector sentiment remains very weak given that there is a political/geopolitical component to the lack of animal spirits (not just an economic component). We need to see savings deposits start to be drawn down for signs that private sector sentiment is changing. This is not happening yet. Equally labor market conditions are also very weak. The CKGSB recruitment survey has offered a much more realistic assessment of labor market conditions vs official unemployment data. Again this would need to improve to show a shift in private sector sentiment.

Secondly, land sale revenue - the lifeblood for local governments - has fallen rapidly for the past 3 years and are yet to recover. This has been a key previous engine of Chinese growth and local government expenditures. To restart this engine, real estate prices would have to rise for developers to want to take on loans to buy more land, likely in lower quality locations. In addition there has been a short-fall in local government bond issuance vs previous years, which again further strangles local government cashflows.

Our main China growth and inflation leading indicators remain at the lows.

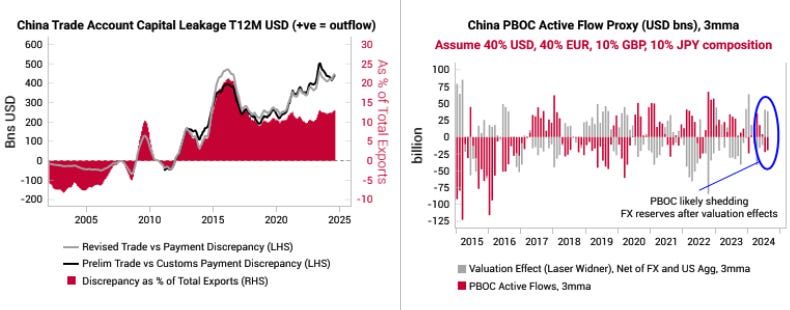

Capital leakage via the trade channel has still not abated. The PBOC has also been actively intervening in the FX markets to strength the RMB against underlying depreciation pressures.

The global implication

This does not change our macro regime, which remains neutral (i.e. neither risk-on, nor risk-off). PBOC policy is one of the components already captured in the policy regime. As we previously noted, the very positive policy component has been helping to offset small headwinds coming from growth, inflation and liquidity.

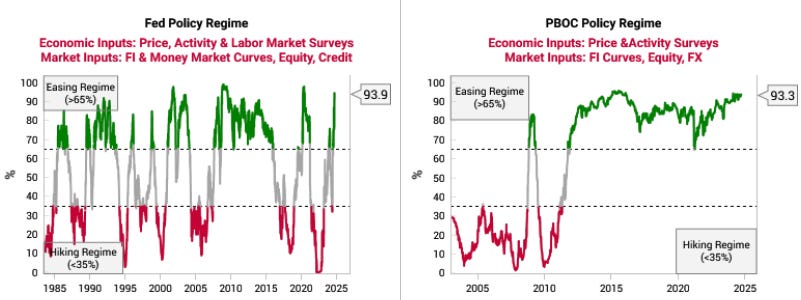

We have been in a synchronized easing regime across the major G3 central banks, which will act to support sentiment and markets. When the Fed eases, it creates more room for other central banks to ease and the PBOC has taken its opportunity.

To read more of our research, contact us here.