Cyclical Factors Align for EM Outperformance

Weekly Wrap, Aug 22 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Weekly Wrap - Aug 22

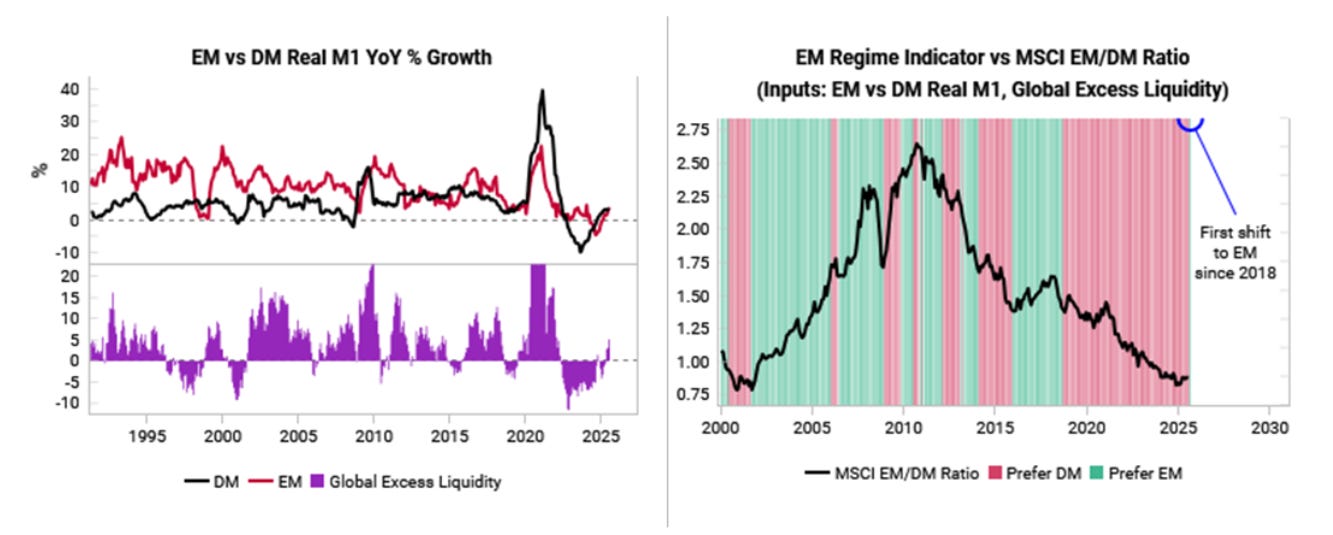

Cyclical factors align for EM outperformance - Aug. EM/DM Leading Indicator Watch

EM economies driving improvements in global growth and liquidity. Inflation leading indicators edging lower for most major DM and EM economies.

Tailwind for risk assets intact as synchronized global easing cycle broadens out. Our liquidity-driven regime model now favors EM over DM equities for the first time since 2018.

We reiterate our long exposure in Brazilian and Indian equities; long KRW (vs CNH) and long CAD (now vs JPY); and long 2-year UK bonds. We are adding short AUDUSD based on tactical and cyclical model alignment.

DM

UK: Downside risks to growth, inflation fears overblown, yields too high

Japan: Signs of peak inflation, path of least resistance is a weaker yen

Canada: Growth LEI turns higher, switch from long CADCHF to long CADJPY

Australia: Falling inflation to keep RBA easing, short AUDUSD on tactical/cyclical alignment

EM

India: US-India tensions a chance to add to long equity exposure

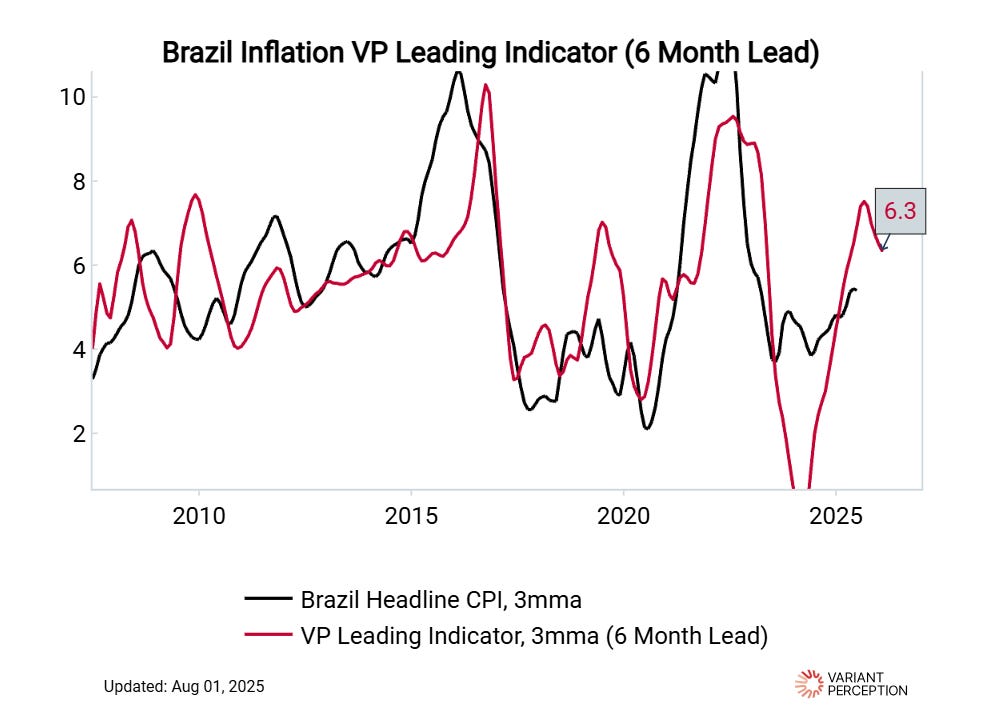

Brazil: Still long equities as focus shifts from inflation to growth

Mexico: Drop in bond yields justified by falling growth and inflation

South Korea: Fiscal still boosting growth, but LPPL bubbles suggest tactical caution on equities