Digging into US data anomalies: micro-businesses + tax avoidance - Excerpt from VP February G3 Leading Indicator Watch

This post is an excerpt from our February 9, 2024 G3 Leading Indicator Watch report to VP clients. The full length, original report can be viewed here.

US fiscal: deficit may have been larger than intended last year

In our Feb Macro Snapshot, we flagged the very strange divergence between low US tax receipts on production and high nominal GDP growth. US personal tax receipts were also abnormally low, likely due to new business applications to take advantage of Covid tax policies.

The large fall in total US personal tax receipts has rarely been seen outside of recessions.

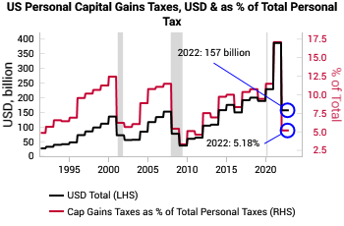

This cannot be solely attributed to capital gains taxes. The second chart shows that total annual capital gains taxes in recent years have been around 150-350bn USD depending on asset performance. The poor performance of assets in 2022 still resulted in 157bn total capital gain taxes.

These capital gains receipts are clearly visible in the April surplus/deficit numbers from the Treasury.

We suspect the fall in personal taxes last year is linked to the surge in new businesses set up after Covid to take advantage of temporary tax policies. Of course there were legitimate business applications with a high propensity to create jobs (red line in chart), but there was an even bigger surge in lower propensity applications (black line in chart).

One risk is that as tax avoidance fades and with the higher expected capital gains taxes for 2023, it could end up reducing the fiscal impulse.

US labor: inconsistent data likely result of micro-business behavior

Micro-businesses with less than 10 employees are behaving very differently to larger businesses. This likely explains the apparent inconsistency of large business layoffs / hiring freezes and the robust aggregated labor data.

Micro-businesses have struggled the most with labor mismatch / hoarding post-Covid, with very elevated job openings and muted hires.

In contrast, larger businesses saw a surge in both hires and job openings after Covid, which has already peaked and are now tracking below pre-Covid trends.

This can be corroborated by US CEO confidence surveys on expected hires and layoffs. We see a steady trend higher in CEOs looking to reduce their workforce and a trend lower on CEOs looking to expand their workforce.

This can also help to explain the apparent divergence of rising WARN notices vs low initial jobless claims. WARN notices are state filings by companies to give notice of mass layoffs, link)

We suspect workers laid off from larger businesses are finding work in micro-businesses. It is also probably reasonable to assume micro-business jobs are worse jobs, corroborating news reports on rising numbers of US workers with multiple jobs to maintain their income (link).

US consumer: personal finance deterioration vs job confidence

The US savings rate and card transaction data continues to show the US consumer remains steady. However, it is hard to ignore some large under-the-hood divergences.

In our 2024 themes, we described the US consumer as a paper tiger, as consumers are NOT worried about finding a job, but they ARE reporting much worse personal finances. This makes consumption vulnerable to a pick up in layoffs.

There is also a notable divergence in sentiment by income group. The next 2 charts show that, unsurprisingly, the top third is in better financial shape and more optimistic on future prospects, whereas the bottom third are struggling with expectations for personal finances making new lows.

The above divergences can help reconcile seemingly contradictory comments from earnings season:

“low unemployment and rising wages… remain key drivers of consumer spending. Some risks we are monitoring include credit availability and delinquency rates" - Mastercard CEO Michael Miebach

“The battleground is certainly with that low-income consumer… What you're going to see is more attention to affordability” - McDonald's CEO Chris Kempczinski

For more insights into our investment framework, visit our website.