Echoes of 2016, 2003 and 1999: Signposts to watch

Weekly Wrap - Jan 9, 2026

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Echoes of 2016, 2003 and 1999: Signposts to watch - Jan. Macro Snapshot

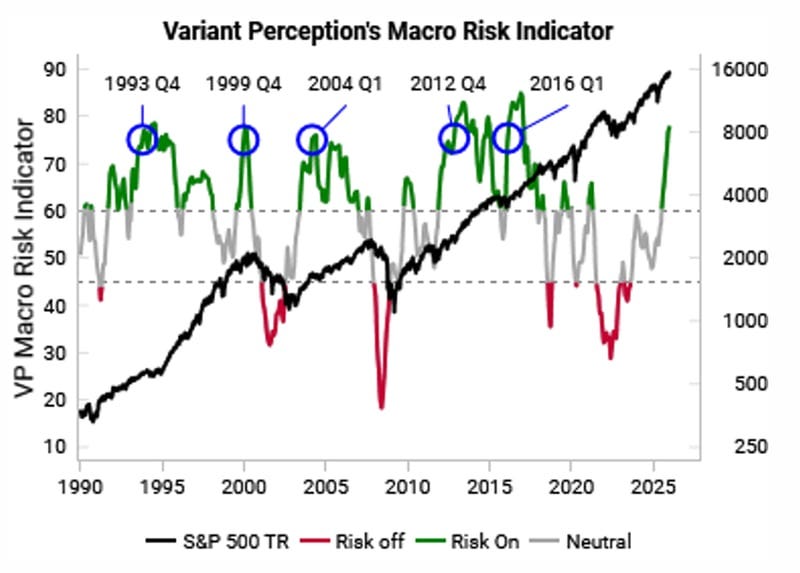

Our Macro Risk Indicator has only been as bullish as today on five occasions. None of these past moments since 1990 can be a perfect match, but three stand out: 2016, 2003 and 1999.

Events in Venezuelan show that history is rhyming again. The United States is re-asserting strategic control over the Western Hemisphere. This was Pillar #1 in our recent thematic, The Primacy of Sovereignty.

Notes

Cyclical Asset Allocation: Macro Risk Indicator as “risk-on” as ’16, ’03, and ’99

2016: Manufacturing recovery after rolling recession

2003: “Jobless” recovery with rising productivity

1999: High valuations and speculative mania with generational IPO

Equity: Consensus optimism vs sound macro => energy/financial/tech barbell, EM, value

Fixed Income: US 10y fair value range of 3.75% - 4%, watch the SOFR curve

FX: More nuanced outlook for USD, but APAC vs EUR remains key divergence

Commodities: Commodity outlook still strong, but parabolic metals rally due for pause