Equities and Yield Regimes

We look at the performance of equities and intermarket relationships across different real yield and inflation breakeven regimes. Today, real yields are starting to drive changes in nominal yields, which is supportive for equity gains

In a recent report for clients, we reiterated the importance of tracking the evolution of real yields and breakevens to assess equity risks. We have looked as far back as 1971 to better understand the track record of equities (and other cross-asset relationships) across different market regimes based on changes in real yields and inflation breakevens.

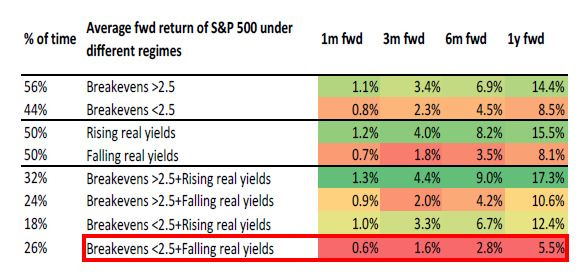

When breakevens are high and real yields are rising year-on-year, this is the regime that is most consistent with a reflating economy and is most supportive for equities. The table below shows the average forward returns of the S&P 500 under different real yield and breakeven regimes (based on monthly data). (Highlighted in red is today’s regime, although we are close to entering the regime above it as real yield’s move becomes positive year-on-year.)

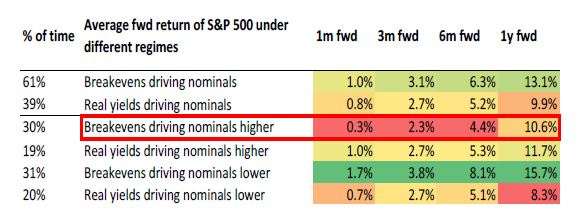

This confirms the positive reflationary picture for equities currently.In the next table, we break down the monthly change in nominal yields to see whether breakevens or real yields are driving the moves. We assume either breakevens or real yields have “driven” the move in nominal yields if one of them has been at least 75% of the nominal move in the last month.

Today, under our definitions, breakevens are not “high” (under 2.5%) and breakevens are currently driving the move higher in nominal yields. Real yields are not (yet) rising on a YoY basis.

Historically, US equities have underperformed when breakevens have driven nominal yields higher. This is a potential vulnerability for equities today given breakevens have been responsible for more than 75% of the move in nominal yields over the last month.

This risk eased in the second half of February with a rise in US real yields and an easing in inflation breakevens.