Euro Fixed Income Insights - Steepening on Schedule

This post is an excerpt from our June 28th report to VP clients (link to original report), showcasing our man + machine analytical framework in action. The combination of our ECB regime models, leading indicators for growth and inflation & market timing is a repeatable process to find high risk-reward trading opportunities.

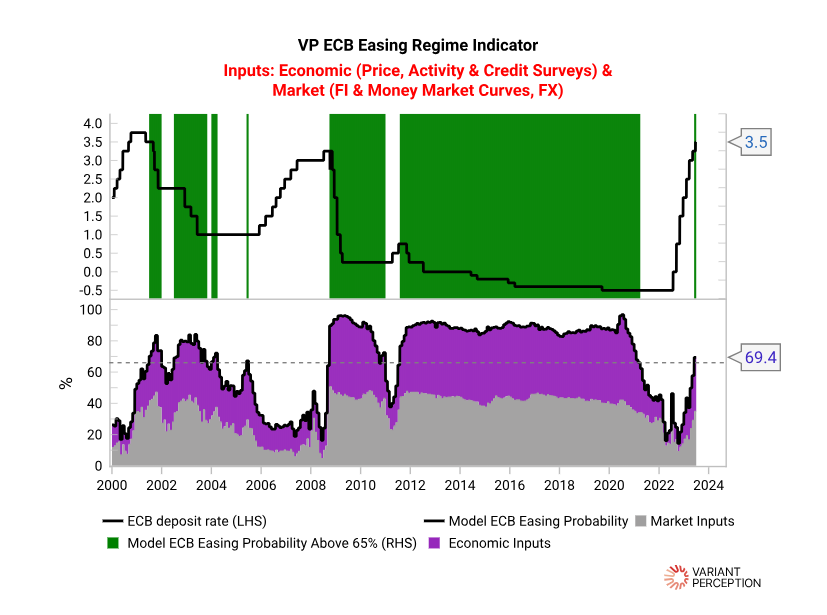

Examining the VP ECB Easing Regime Trigger

Our VP ECB Easing Regime model was triggered late June. Despite this, Christine Lagarde's remarks at the time remained noticeably hawkish, driving further curve inversion. Our central bank regime models were designed to help with timing fixed income turning points.

Our models combine both economic and market metrics to quantify the probability of central bank policy pivots, aiding in pinpointing potential market mis-pricings in outright rates and curve positions.

Snapshot of model on June 28th:

The Opportune Moment to Bet on Steepeners

At the time, the EUR 2s10s 1y forward had once again inverted dramatically, presenting a great entry point to bet on steepeners. A trade that turned out to almost immediately head in the right direction. Outright steepeners were attractive at the time, as well as yield curve caps.

Snapshot of EUR swaps curve on June 28th:

A Dim Growth Outlook

The growth forecast was notably bleak at the time. The eurozone recession model (Lasso regime) remained active with tangible stress evident in metrics such as German manufacturing orders. Key indicators like the EuroCoin activity and real M1 growth have also trended negatively.

Snapshot of model on June 28th:

Sweden as an Early Warning System

Sweden, often an early indicator for eurozone activity, corroborated the weak outlook.

Snapshot of indicators on June 28th:

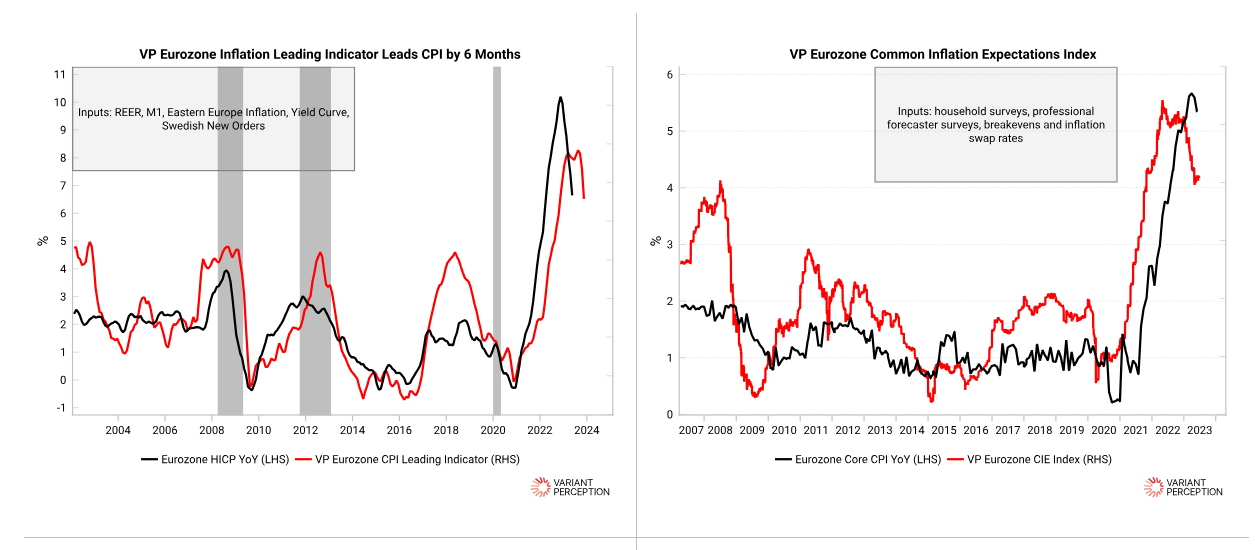

Eurozone inflation: The Worst Likely Behind

While Eurozone inflation expectations remained elevated, forward-looking indicators suggested the apex had already passed. We hypothesized the market and the ECB was too focused on the supercore CPI and rising nominal wage growth.

Snapshot of indicators on June 28th:

Conversely, our eurozone inflation LEI was already rolling over, and business price surveys reflect diminishing inflationary tensions.

Snapshot of models on June 28th:

Time to Focus on Eurozone Growth Risks

The EUR was in the"stagflation surprise" quadrant, due to positive inflation surprise and negative growth surprises. These conflicting forces created the potential macro backdrop that enables mean-reversion trades to work better.

Snapshot of indicators on June 28th:

For a comprehensive insight into our investment framework, visit https://portal.variantperception.com