Fiscal: Sisyphus or Hercules - Excerpt from VP February Macro Snapshot

This post is an excerpt from our February 1, 2024 Macro Snapshot report to VP clients. The full length, original report can be viewed here.

Fiscal: more Sisyphus than Hercules

The US fiscal impulse is back to neutral again (left chart), showing a run rate of 6.4% of GDP deficit on T12M basis (right chart).

This ongoing fiscal deficit, alongside the drawdown in household savings, has been a major support for corporate profits. This can be shown using the Kalecki-Levy profit decomposition. The red area in the below chart shows the rising government deficit, while the purple area is household savings (negative as more household savings reduce corporate profits).

The post-Covid environment has been rare in history, with a simultaneous drop in household savings and surge in fiscal deficits. Historically fiscal deficits only surge in recessions when household savings are rising. Today’s rare combo has enabled real durable goods consumption to stay elevated.

The impact of fiscal has been obvious, but we see signs that suggest an elevated dependence on continued fiscal spending. Like Sisyphus rolling the boulder up the hill, the US economy remains vulnerable to any drop off in fiscal spending.

Tax receipts on production diverge vs GDP

Historically there is a very good correlation between nominal GDP and taxes on production & imports. Today’s situation of high nominal GDP growth vs barely growing tax receipts on production is rare.

We have previously speculated that this gap is partly explained by generous green tax credits in the Inflation Reduction Act and partly explained by the economy being weaker than the headline nominal GDP suggests.

Overall, coincident growth data continues to track between a soft landing and hard landing.

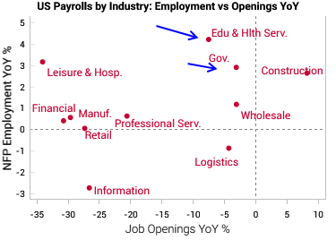

The government’s impact is clear in the sector payroll data. Government and education / healthcare jobs are seeing strong growth and muted falls in job openings. Other sectors are seeing big drops in openings, but employment has yet to react given labor hoarding/hiring difficulties that we have previously discussed.

The diffusion of state coincident growth indices has also deteriorated, which has usually occurred in recessions. This data is subject to revisions, but is another sign that the economy is not doing as well as headline GDP suggests.

For more insights into our investment framework, visit our website.