Growth steady, inflation risks known, fade policy divergence

Weekly Wrap, Sep 12 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Research

Growth steady, inflation risks known, fade policy divergence - September G3 Leading Indicator Watch

US: Housing and labor markets are in slow motion deterioration, but consumption remains resilient, while there are signs of manufacturing green shoots.

China: LEIs are still recovering, and excess liquidity will help equities more than the real economy. Deflationary spill over to other economies looks set to persist.

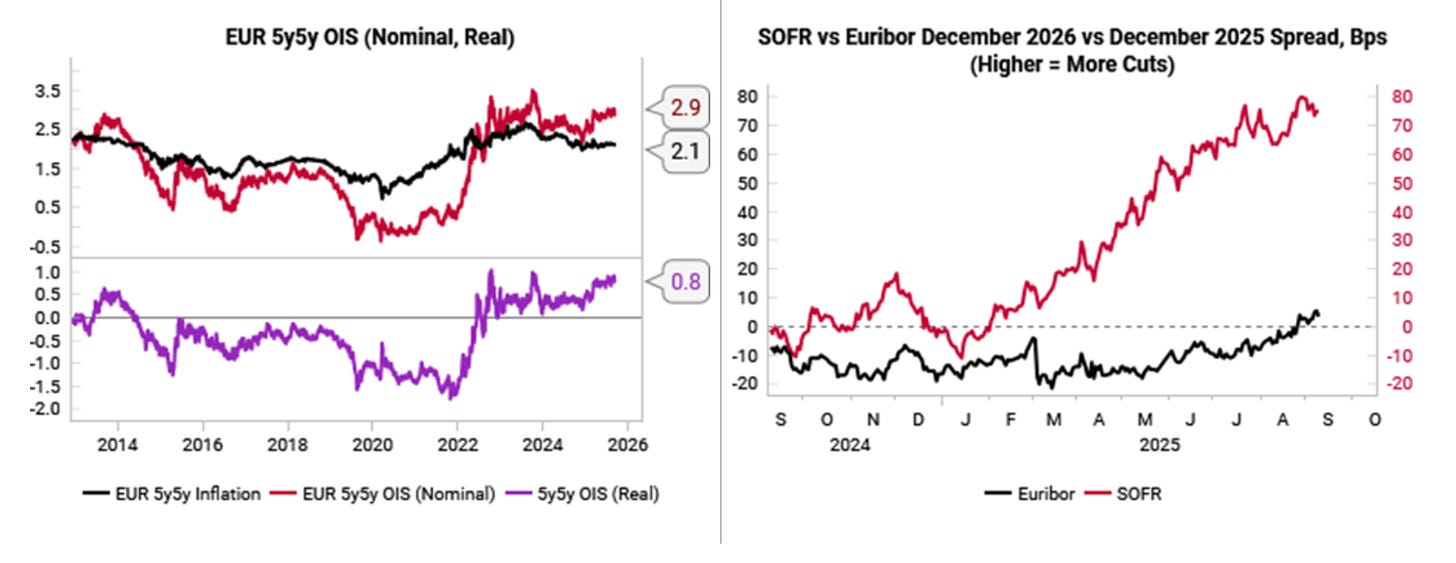

Eurozone: Markets are pricing 3 Fed cuts in 2026 vs 0 cuts for the ECB. This seems too divergent given the relative growth/inflation outlook

Notes

Buy the rumor, sell the fact into Fed + global macro updates: We are taking profits on our long SOFR, while retaining a long USD bias into next week. We add long USDKRW as our preferred long USD exposure alongside short EURUSD. We close our short CNHKRW for flat and stop out of short AUDUSD.

Eurozone Inflation: SOFR vs Euribor pricing too divergent, 2026 priced for 3 Fed cuts, 0 ECB cuts: With inflation falling and growth steady, EUR real yields (e.g. 5y5y real OIS) seem too high. Meanwhile, our ECB regime model remains firmly in the easing regime.