Housing: the inflation dog yet to bark

Following on from our recent posts on inflation risks, we dug into what specific components could drive inflation higher. Housing represents an outsized component, comprising 31% of headline CPI and 40% of core CPI in the US.The below chart plots the top CPI components by their % weight vs YoY change.

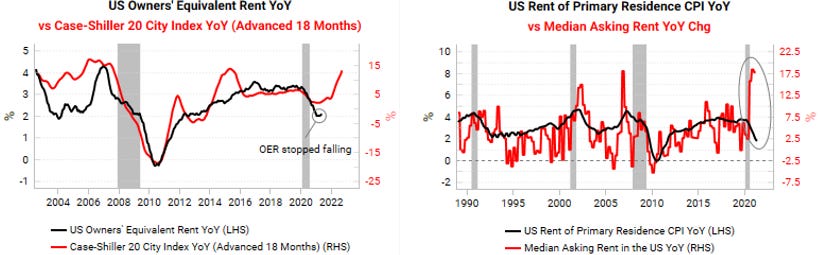

The market and media have focused on transitory components like motor fuel and transport commodities (ie used car prices), but owners' equivalent rent (OER) and rent of primary residence are more critical for the direction of US inflation.So far housing CPI has been muted, but it typically lags house price growth by about 18 months. Red-hot housing market data has not yet fed through into CPI as a result of measurement issues during Covid and rent controls. The CDC eviction moratorium is now due to end as landlords are asking for much higher rent. Persistent inflation risks are growing in the US.

Get the full picture at variantperception.com.