In Case You Missed It

We're Back Jan 5, 2026

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Part 1: The appropriate amount of greed (Dec 2)

The cyclical policy and macro backdrop remains supportive of risk assets next year. We acknowledge legitimate concerns about US labor/housing markets and high equity valuations, but still see opportunities in equities among EM, value, and laggards amid stable bond yields and a mixed dollar outlook.

Although consensus expectations are not as uniform as last year, we once again present our 10 surprises for 2026 in tribute to Byron Wien:

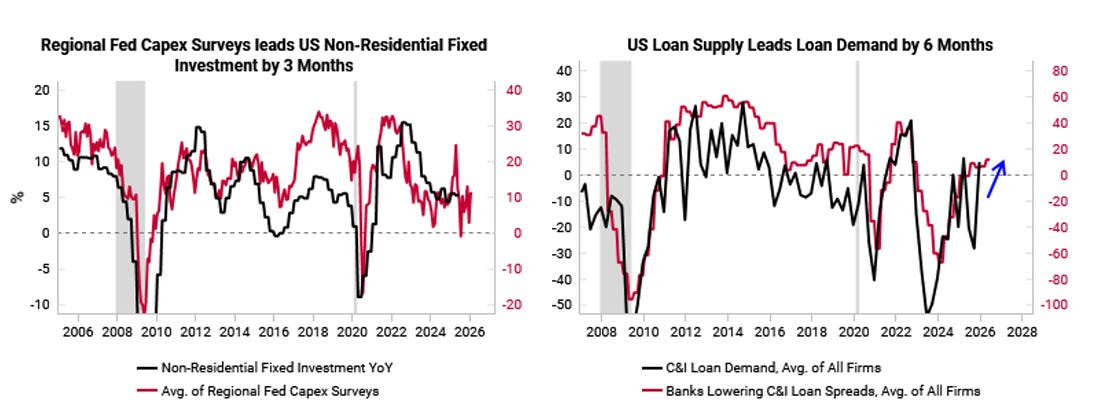

#1 Trump’s capex boom arrives a year late, broadens beyond AI

#2 US growth surprises to the upside despite muted labor market

#3 Housing disinflation breaks sticky inflation narratives

#4 US 10y yields go nowhere, trades in a tight range around 4%

#5 Value equities outperform growth

#6 G10 FX divergence: Apac (AUD & NZD) over Europe (EUR & GBP)

#7 EM equities outperform DM, led by Brazil

#8 Oil trades below 50 and above 75 at some point during the year

#9 China tech stocks outperform US tech stocks

#10 Capital Cycle: US regional banks & energy services outperform

Part 2: A US-China world, and Europe is just living in it (Dec 8)

US: Most leading indicators point to continued resilience despite muted jobs growth, and manufacturing could exceed expectations if capex broadens out amid Fed easing.

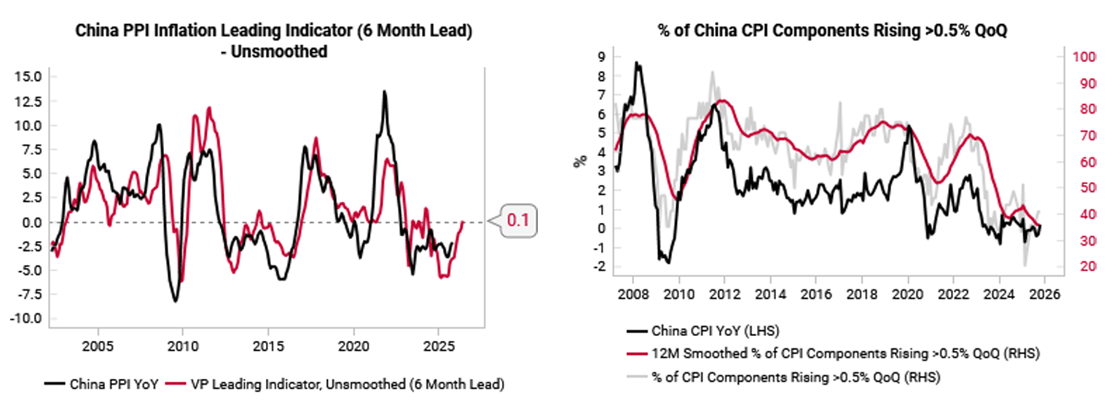

China: The Chinese focus on net exports will mean that disinflation continues to spill over globally. We are skeptical the Chinese government is ready to revalue the RMB stronger, until they are confident in China’s leverage vs the US.

Eurozone: Leading indicators point to a cyclical rebound but weak structural competitiveness from high energy costs and a strong euro make a reflation unlikely without a much weaker euro.

Part 3: Country-specific drivers to matter more in 2026 (Dec 11)

Cyclical macro tailwinds remain strong as the global trend towards loose monetary policy, more fiscal easing, and resilient growth leading indicators is intact. We suspect 2026 will be a year where country-specific drivers can have more impact, leading to outsized divergences in relative performances across countries.

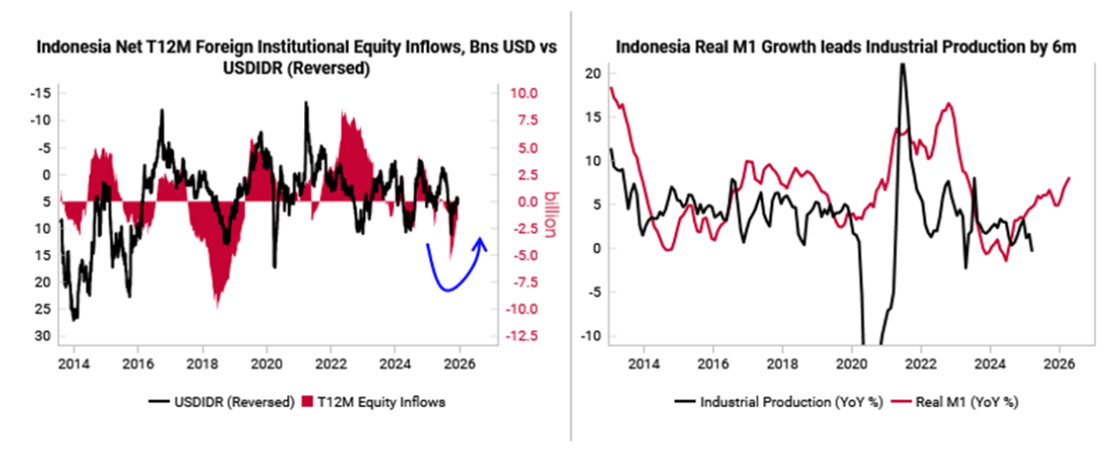

New Ideas: Short USD vs long IDR; long Indonesian equities (Link to Top Global Macro Ideas)

DM

Japan Resolving the impossible trinity problem means JPY can finally rally in 2026

UK Growth LEIs yet to bottom, necessary to support domestic equity rally

Canada Steady growth and inflation LEIs, 10y bond short (yield up) playing out

Australia Accelerating nominal growth, stay long AUD vs short EUR

EM

Brazil Disinflation the key macro driver, stick with riskparity, add on election volatility

Mexico Growth downside risks, USMCA renegotiation looms

Indonesia IDR and equities have catch up potential in 2026 as headwinds fade

South Africa Broad tailwinds from easing cycle, low energy prices, high metals price

This piece really made me think. Your rigorous aproach to market predictions is generely impressive. I appreciate the clarity of your quantitative models, avoiding those black boxes. The 10 surprises for 2026, especially the AI bit, offer a lot to consider. Thanks for the clear, insightful outlook.