Inflation Outliers - Excerpt from VP September EM Leading Indicator Watch

This post is an excerpt from our Sept 22nd report to Variant Perception (VP) clients (link to original report), digging into lesser-followed country-specific themes across EMs.

Brazil: Ride the Easing Cycle Down

Brazil local-currency sov debt (our favorite EM investment since 2022) remains attractive. Disinflationary pressures allow the BCB plenty of room to cut.

The Monetary Policy Committee (Copom) of the BCB cut the policy rate (Selic) by another 50 bps in September to 12.75% in a unanimous decision.

The BCB reiterated the need to maintain a contractionary monetary stance until the disinflationary process consolidates, and the signs are very good for this.

Our inflation LEI continues to make new lows, while inflation breadth falls sharply.

The diffusion of CPI components rising more than 0.2% MoM is collapsing.

Besides, various measures of inflation expectations have also been trending lower.

India: Disinflation Trend Beyond Food

Food inflation risks from a deficient monsoon remain an upside risk against an otherwise disinflationary outlook. EM equity fund’s India positioning near 10y lows.

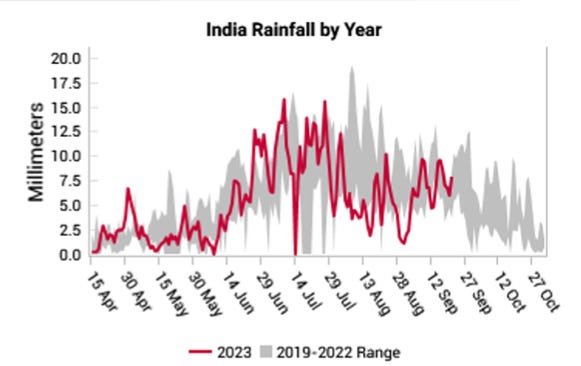

August was the driest monsoon in 120 years, and rainfall continues to be deficient. Rainfall is tracking below long-term averages in all the regions (except north-west). Food CPI is still elevated but has begun to roll over.

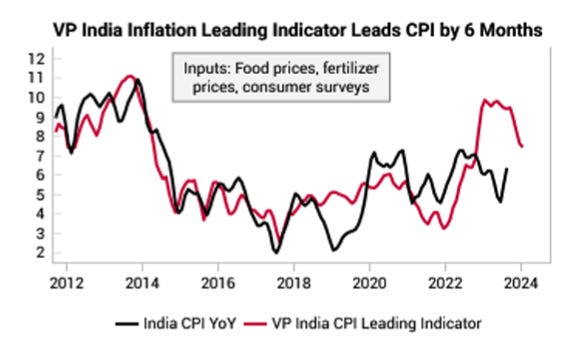

Our inflation LEI continues to point to broad-based disinflation outside of food. The previous divergence in our inflation LEI vs. realized inflation was explained by Indian food and oil subsidies.

Household inflation expectations continue to trend down, which should give the RBI some room for a cautious hold to observe food inflation impacts.

India’s growth remains domestically driven. Commercial credit growth is on the rise. RBI surveys point at robust loan demand and loosening lending standards.

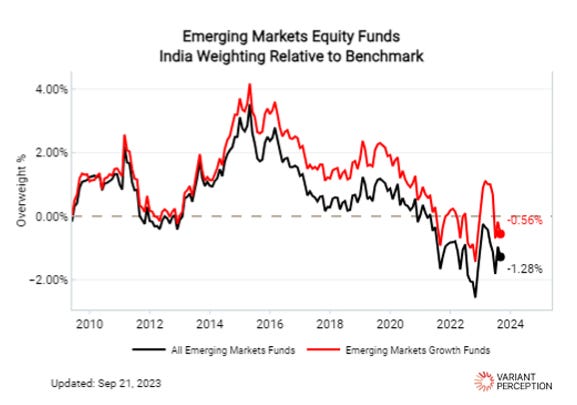

Despite a relatively optimistic outlook, our proxies suggest small underweights for EM equity funds, which is surprisingly conservative.

Mexico: Disinflation Amidst Friendshoring

The Mexico narrative is based on Banxico’s focus on upside inflation risks. However, LEIs are aligned with more disinflation.

Services CPI is rolling over. Core inflation has fallen < 6% - first time since Dec 2021 -.

This provides some breathing room for Banxico, which has indicated it’s happy to stay higher for longer, pending inflation persistence.

The Banxico vs. Fed funds rate is at the high end of history, which usually marks the start of MXN duration rally.

We also note that portfolio flows have turned positive.

Downside growth risks are less evident in Mexico as structural friend-shoring dynamics offset cyclical weakness in global manufacturing. Exports surged in July, particularly automobiles. Mexico has surpassed China as the US's largest importer.

For a comprehensive insight into our investment framework, visit