Leading indicators point to “risk-on” cyclical outlook

Weekly Wrap, Sep 5, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Research

Leading indicators point to “risk-on” cyclical outlook - Sep. Macro Snapshot

Risk of a tactical wobble (weak seasonality, stretched CTA exposure) does not take away from bigger picture: cyclical macro backdrop is improving.

Q3 US growth scare fading, global liquidity rising, and most central banks easing in sync.

We would look to start shifting away from our balanced allocation, preferring equities over fixed income.

We are not blind to high valuations in US indices, but we see pockets of relative value in energy and healthcare sectors as well as select emerging markets. Within fixed income, we still prefer TIPS vs nominal bonds.

Notes

Cyclical Asset Allocation: LEIs show “risk-on” tailwinds, as US growth scare fades

Cyclical Asset Allocation: Improving macro outlook driven by liquidity, policy and growth

US Growth: Still resilient growth LEI, as GDPNow and services recover

US Growth: Household savings rate falls again, fiscal deficit remains large

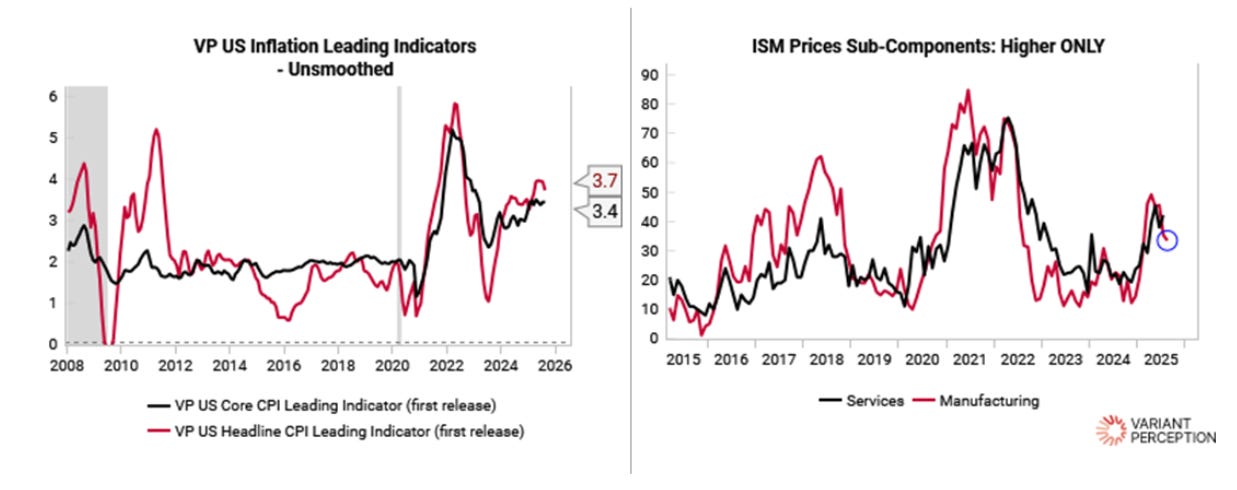

US Inflation: First sign of inflation pass-through, one to keep an eye on

Equity: Earnings LEI steady but high US valuations suggest being selective

Fixed Income: Tactical signals suggest long-end yields biased higher

FX: Tactical and cyclical bullish in

dicators aligning for a US dollar rebound

Commodities: Commodity outlook continues to improve, stick with gold exposure