Lessons for today from the 1929, Nifty Fifty and Dotcom bubbles

Weekly Wrap, Oct 17, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

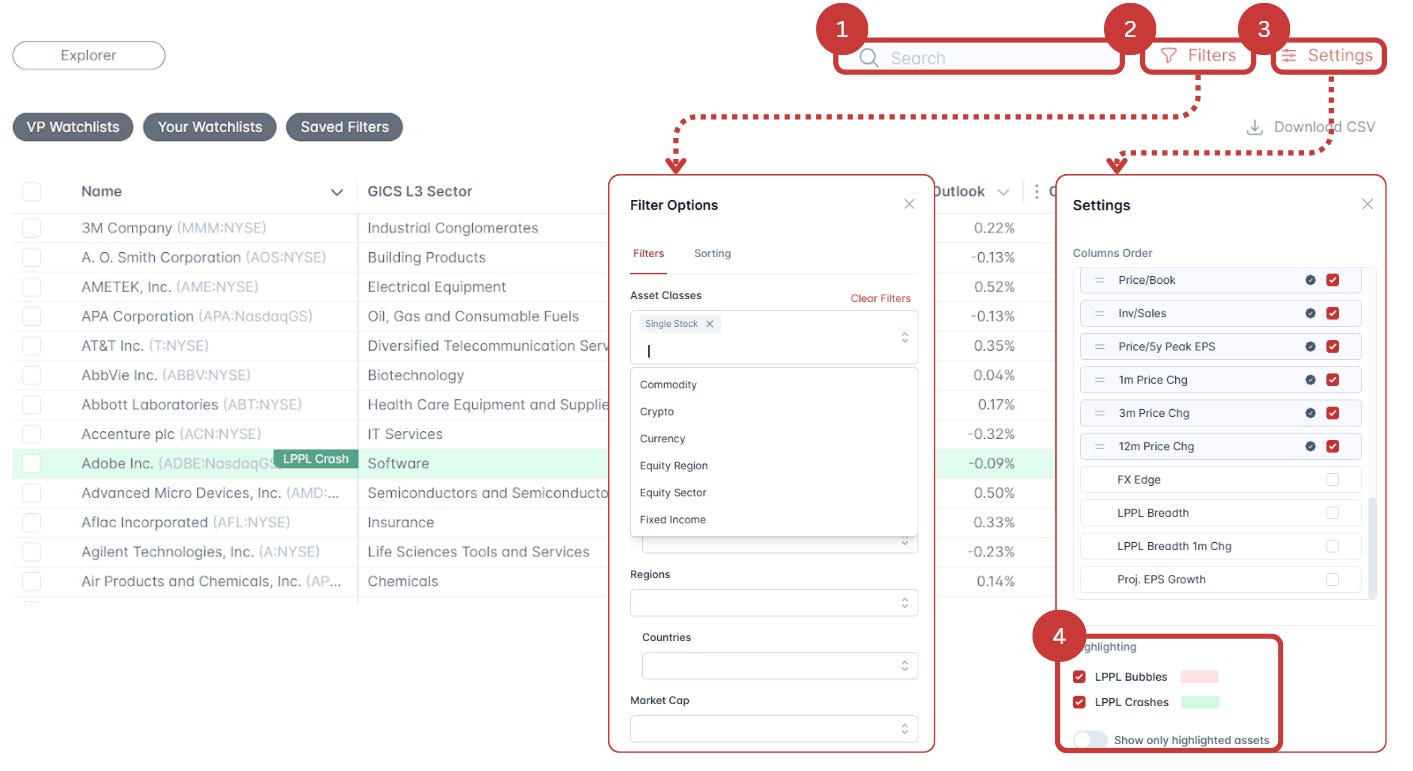

Our New Asset Explorer

Search and filter across all major asset classes (equities, single stocks, fixed income, commodities, crypto, and more).

Select multiple assets to compare and chart with our proprietary models and scores.

Build and monitor your own personalized watchlist.

Create custom scores to filter with.

Notes

Lessons for today from the 1929, Nifty Fifty and Dotcom bubbles

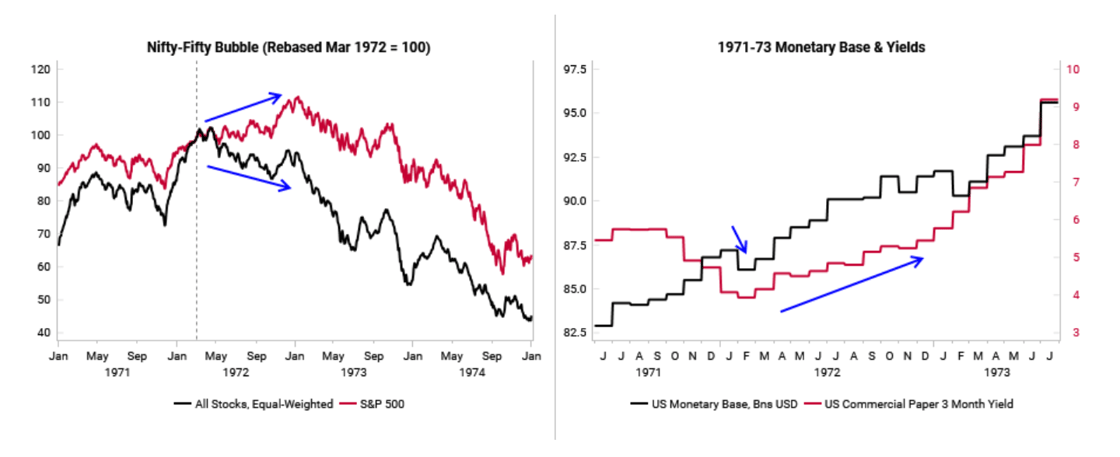

A bubble can go on for longer than expected due to feedback loops in investor and corporate behavior. As context to today’s AI moment, we re-visit our work on the bubbles of 1929, Nifty Fifty and Dotcom.

Historically, there are two key signposts of a bubble nearing its end:

(a) Narrow market breadth

(b) Monetary policy tightening and liquidity headwinds

The time to really start worrying is when the average stock starts to make lower highs and lower lows, while monetary policy pivots back towards tightening.

Opportunistic long VIX to hedge risk asset exposures

The old saying in risk management: buy protection when you can, not when you have to.

We’ve been intentionally opportunistic in flagging when the volatility market presents attractive risk-reward opportunities to add long vol exposure. Today, our indicators once again signal a favorable tactical setup to go long volatility.

Our tactical “complacency” signal has triggered again for US equities. US single-stock implied volatility is now very elevated relative to the S&P index volatility.