More leading indicators are rebounding - Excerpt from VP April G3 Leading Indicator Watch

This post is an excerpt from the Eurozone section in our April 10, 2024 G3 Leading Indicator Watch report to VP clients. The full length, original report can be viewed here.

Eurozone: growth outlook continues to improve despite Germany lagging

The balance of risk remains to the upside for the European growth story. Our Eurozone recession indicator has collapsed to 8%, by far the lowest level amongst G3 countries.

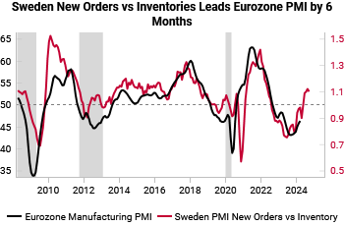

We continue to see improvement in the key Eurozone leading data we track. Sweden, as a small open economy exposed to the global industrial cycle, often leads Eurozone growth. Improving Swedish new order to inventories suggest Eurozone manufacturing PMI is still cyclically biased higher.

Contrary to Eurozone composite PMI reaching expansionary levels for the first time in 10 months, Germany continues to struggle.

Germany’s economic weakness has been broad based since 2023 but is being more acutely felt in industry than consumption. Energy costs continue to weigh on industrial production, with the spread between non-energy intensive and energy intensive industry production at historic levels.

However, the steady improvement in business expectations implies industrial output should begin to improve in the second half of the year alongside the rest of the Eurozone.

Eurozone: disinflation story more accepted, balance of risks for inflation now more neutral

Leading indicators in the Eurozone remain broadly aligned with disinflation, a reality that has become more accepted by the market. However, increasing expectations of higher future selling prices is cause for concern and shifts the balance of risk for inflation more neutral.

The consensus view is that June will be the start of an ECB cutting cycle, with the odds of a 25bp rate cut currently priced at 85%.

The broadening out of disinflation supports this, with the percent of CPI components rising > 2% YoY now below 80% for the first time since September 2022.

The Citi Eurozone Inflation Surprise index remains suppressed, which historically leads Eurozone CPI by 6 months.

We continue to see a bottoming trend in selling price expectations more broadly, which creates a potential floor for CPI.

More specifically, the key risk to the disinflation narrative remains within services. The ECFIN services price survey is bottoming and still needs to be tracked closely for upside risks to services inflation.

For more insights into our investment framework, visit our website.