More vol = more opportunities

Weekly Wrap, Nov 21, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

More vol = more opportunities - Nov. EM/DM Leading Indicator Watch

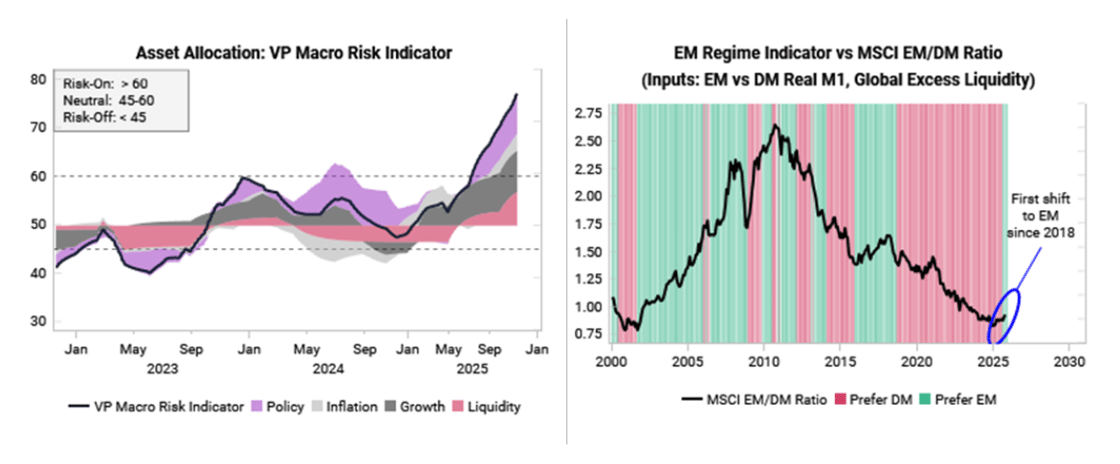

For asset allocation, cyclical regime models still prefer EM over DM. Macro risk models suggest 6m outlook favorable for risk assets.

Given market divergences we last noted, current bout of risk-off not completely unexpected. Ultimately opportunity to add risk.

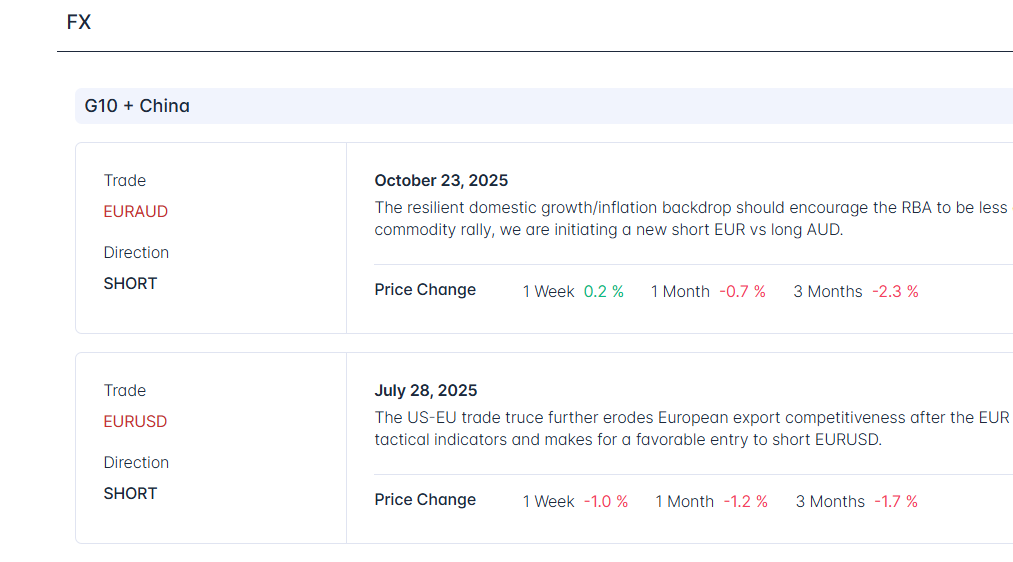

Market volatility is creating new opportunities and reasons to take profit. We are closing long USD vs short KRW after a very favorable move over the past 2 months. We are also very close to initiating new longs in JPY and NZD.

Find the full list of our top global macro trading ideas by asset class. Primarily rates and FX focused, with opportunistic equity trades (link)

Observe price changes to assess idea.

DM

JPN: Disorderly yield surge suggests JPY sell-off near exhaustion

CAN: Lingering inflation + fading growth concerns => stick with 10y bond short (yield up)

AUS: Growth & inflation holding up, still like short EUR vs long AUD

NZ: Growth bottoming + NZDUSD LPPL crash exhaustion into RBNZ meeting

EM

BRA: Inflation rolling over => stick with long bonds and long equities

MEX: Growth backdrop remains weak, MXN likely to underperform as Banxico eases

SK: Growth outlook continues to improve, take profit on long USD vs short KRW

SA: Energy importer + metals exporter = structural sweet spot