Opening the Box on Schrodinger's Recession

What is still recessionary and what’s been different this time?

This post is an excerpt from our October 1, 2024 Macro Snapshot report to VP clients. The full length, original report can be viewed here. To gain access to more of our research, contact us here.

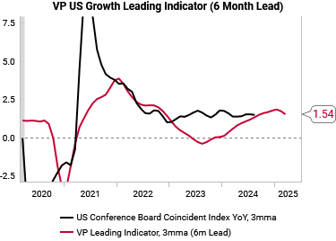

The message from our US growth LEI remains one of an economy that is slowing and set to grow at slightly below trend (but still positive).

Our US recession model probability has fallen throughout 2024 and has now dropped below 50% for the first time since January 2023.

Recent 2Q GDP revisions were also significant. GDI (Gross Domestic Income) was revised higher, closing the GDI to GDP gap in favor of stronger growth. This also confirms our Kalecki-Levy work that lower consumer savings alongside large fiscal deficits boosted incomes.

Today, GDP, GDI and retail sales look stable. It is only industrial production that suffered a recession.

The below two sections dig into what aspects of the economy are still recessionary vs not recessionary.

What IS still recessionary?

There are a few components of our US recession model that remain recessionary.

In the labor market, permanent job losers have been rising (similar to Sahm rule), although this is NOT being confirmed by jobless claims data or other diffusions we track like the Philly Fed diffusion.

The jury is also out on the yield curve. The un-inversion of 2s10s has made headlines, but the Fed themselves prefer to look at the 3m vs 3m 18m forward curve for recession risks. This remains inverted and the un-inversion historically is supposed to be the recession warning. We suspect in this cycle, this indicator is also out of sync.

There is currently a stark difference between single family and multi-family building activity. Multi-family building permits have collapsed (black line, below chart) while single family permits have slowed more gently and look to be back to pre-Covid trends (red line, below chart).

Smaller businesses look to have already suffered a recession. Operating margins for non-financial non-corporate firms have already collapsed (red line in below chart). This is where the recession has been.

What’s been different this time?

In our June US consumer report we highlighted how large fiscal deficits and low effective mortgage rates have contributed to low consumer savings rates, which is propping up incomes. This relationship still holds.

Mortgage lending standards are also loosening, which historically leads consumer credit growth.

The benefit of low effective mortgage rates is also shown in overall household debt service ratios, which have gone sideways. Higher interest rates have hurt lower-income consumers, leading to a bi-furcated US consumer, but in aggregate things are holding up.

While some select labor market indicators are recessionary both US initial and continuing claims have stopped their usual surge seen at the start of recessions.

To read more of our research, contact us here.