Quantifying Herd Mentality In Today’s Markets

The post below is based on our note to VP clients on July 27th.

In today's volatile markets, it's vital for financial decision-makers to stay ahead of the curve. The modern investor must navigate a landscape where sentiment and crowd behavior play a critical role.

Understanding Crowding in Stocks

Traditionally, crowded stocks benefit less from good news and are hurt more by bad news than their uncrowded counterparts. We can quantify and utilize this phenomenon..

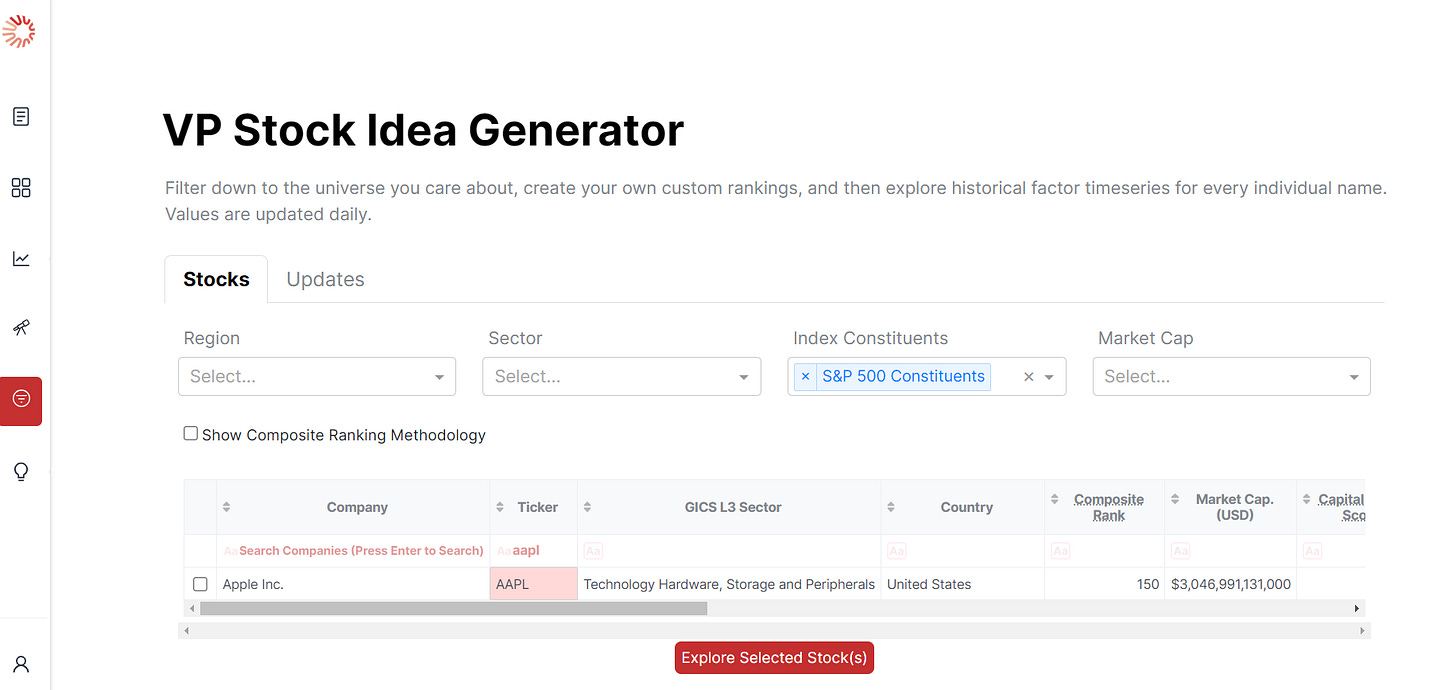

The VP Crowding Score uses unique and uncorrelated inputs to capture behavior in a broad range of investor types and flags when a stock is most or least at risk from herd mentality. This is a key part of our equity framework that ranks companies through our Stock Idea Generator.

Unique Inputs: Capturing Diverse Behavior

VP’s crowding score incorporates five diverse inputs:

VP Fast Money: Isolating speculative behavior.

EPS Estimate Momentum: Monitoring 2-year growth in forward EPS estimates.

Buy Recommendation Percentage: A measure of bullish momentum

Active Fund Sector OW/UW: Reflecting the allocation choices of actively managed

YoY Growth in Active Fund Top 20 Positions: Capturing the strategic shifts of actively managed funds.

Universality: Cross-market Implementation

VP’s Crowding Score is calculated across three distinct universes:

United States: Russell 3000 universe (3k names currently, 7.6k companies overall)

Developed Markets ex-U.S.: Vanguard Total World universe (4.1k names, 6k companies overall)

Emerging Markets: Vanguard Total World universe for other countries (2.5k names, 4.1k companies overall)

Conclusion: The Tactical Edge in Crowded Markets

In a world where financial markets are driven by sentiment and herd mentality, VP’s Crowding Score helps investors to play the game. Its application in ranking stocks, understanding volatility, and predicting reactions to earnings makes it indispensable for modern investors.

We use capital cycle and crowding to find attractive investment targets. Try it in our Stock Idea Generator.