Rate impact on banks

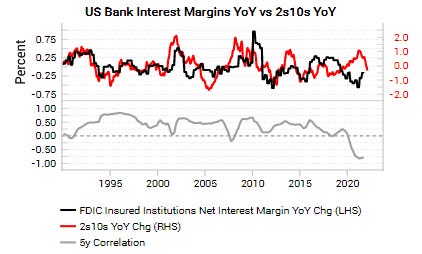

US bank net interest margins were historically very correlated to the yield curve (e.g. 2s10s). However in recent years, the correlation has broken down (chart below). This has coincided with the QE era and the surge in bank reserves and cash assets held by banks.

The interest received on commercial bank’s cash assets is increasingly important to driving profitability. Commercial bank cash assets are now a large multiple of bank market caps (left chart). Rising short-term yields (absolute and relative to rates offered on deposits) are more correlated to bank interest margins since 2015 (right chart).

Thus from a top-down cyclical point of view, US banks should have support from rising yields as the Fed hikes, despite flattening yield curves. From a structural point of view, bank valuations remain on the expensive side at present (left chart) with price to tangible book value at 1.75x standard deviations above 10y averages. The capital cycle still favors banks, as the previous drop in industry revenues to assets points to a period of less competition and recovering margins over the next 2 years.