Staying the course - Nov. Macro Snapshot

Weekly Wrap, Nov 7, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Staying the course - Nov. Macro Snapshot

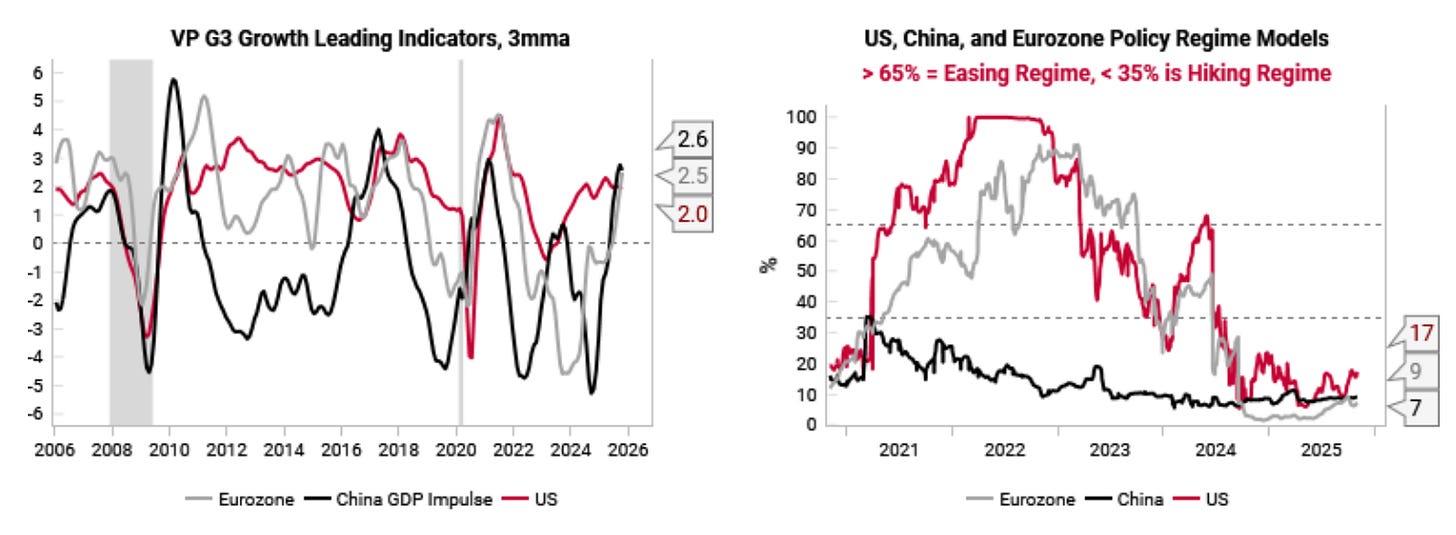

LEIs still support risk assets over the next 6m. Policy and liquidity tailwinds are intact while our growth LEIs for US, Eurozone, and China are elevated. Our “no recession” Fed easing cycle roadmap is starting to play out (stronger USD, higher equities, rising yields).

Tactical: notable divergences in US equity markets and optimistic earnings estimates. Reason for caution with nimble portfolios.

Despite US data blackout, available data suggests consumption and manufacturing are resilient. Watch labor and housing for further weakness.

Sector Notes

Cyclical Asset Allocation: Growth, policy, and liquidity tailwinds persist

Fed Easing Cycle: Equities, USD still tracking “no recession” Fed easing cycles

Tactical Warning Signs: Notable breadth and credit divergences

US Growth: Resilience from consumption and manufacturing …

US Growth: … but labor and housing markets remain weak

Equity: Earnings optimism elevated, macro tailwinds for value, EM

Fixed Income: Yields trading around fair value

FX: USD short squeeze thesis playing out

Commodities: Outlook strong, energy and industrial metals still cheap vs gold

Watchlist / Alerts

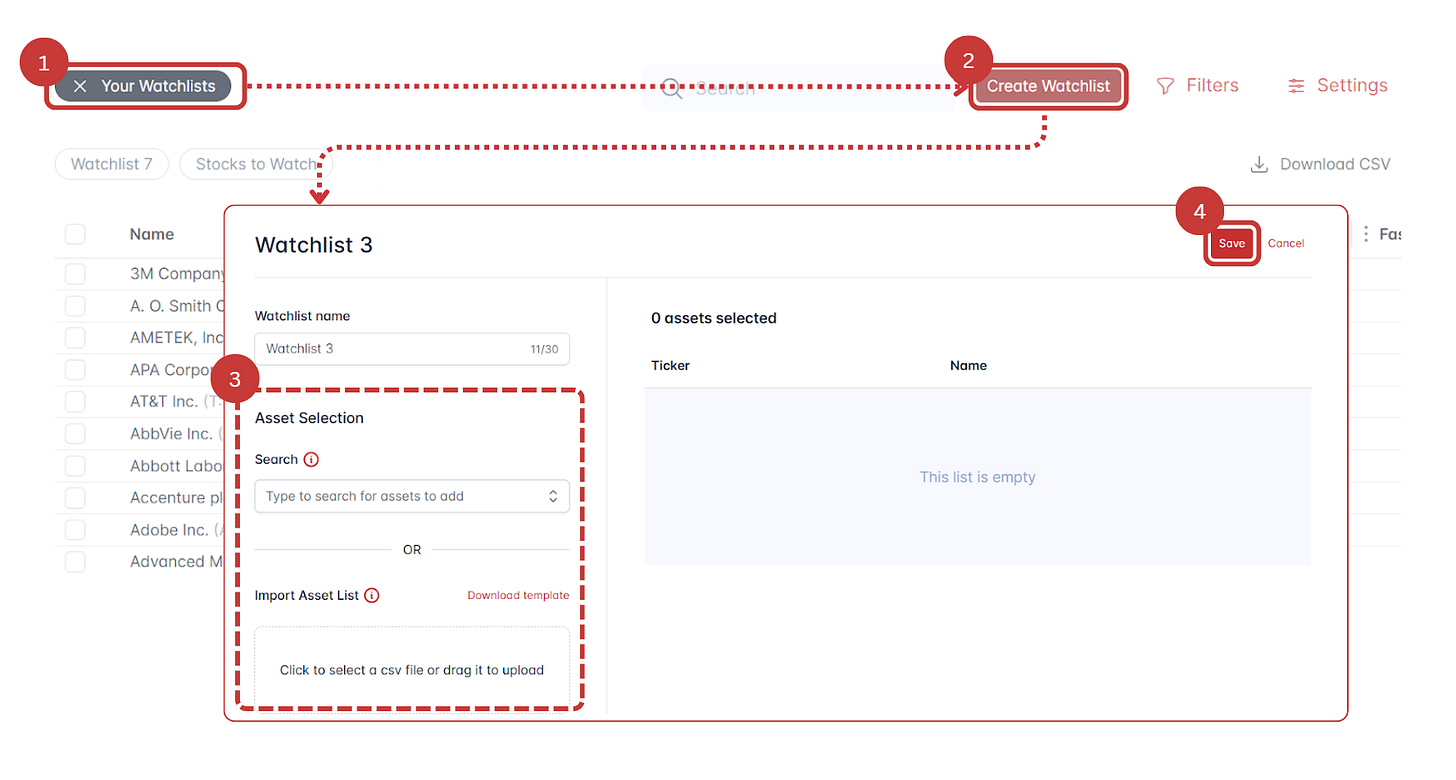

Build and monitor your own personalized watchlist on Asset Explorer.

Receive email alerts for tactical triggers from your watchlist.

Search and filter across all major asset classes (equities, single stocks, fixed income, commodities, crypto, and more).