Sticking to fixed income duration overweights

Our analytical framework involves 3 different time horizons:

Tactical (1-3 months trading outlook)

Cyclical (6-12 months liquidity/growth outlook)

Structural (2-3y+ outlook based on valuation, regime shifts, demographics etc).

Today, for fixed income, all our cyclical indicators support buying dips on a 6m+ outlook. The only concern is that the short-term tactical trading context remains bearish and needs to clear up before a max long duration trade. The below is an excerpt from our Sep 27th report to clients.

We revisit FOMC transcripts during the Volcker-Fed era to give us more context on the structural set up for bond investors. Our key takeaways: FOMC members viewed long-dated yields as a signal of inflation expectations and credibility of the Fed’s disinflationary policies and the FOMC was worried that the public would expect a monetary policy U-turn as the recession deepened.

“[The] real purpose of our October 6 actions was to get inflation under control… we’re right in the midst of a great credibility test...I think that our credibility and hence our impact on long-term rates will be messed up if we don’t meet those goals that we’ve announced.” – San Francisco Fed President John Balles (20th Nov 1979).

‘‘If we were to attempt to ease, it’s pretty clear that everybody would think we had let the inflationary cat out of the bag. And it seems to me that interest rates would be even higher under those circumstances.’’ – Fed Governor Schultz (31st March 1981).

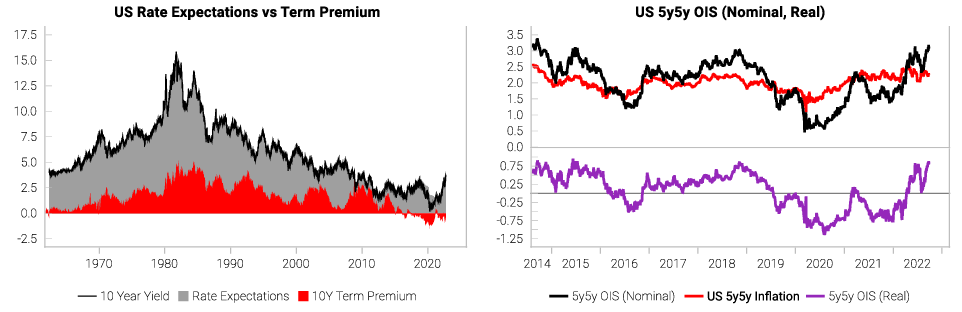

In an echo of Mario Draghi’s “whatever it takes” moment, Powell was unambiguous in stating that Fed policy “will be enough” to contain inflation. The inflation swaps market agrees. The left chart shows the inflation swaps term structure remains well behaved and trades below 3%. The OIS term structure (right chart) has also been dragged up materially vs earlier in the year.

Surging term premium would be a sign of loss of Fed credibility, and is a key risk for our bullish bond views. But there are little signs of that so far. The 5y5y real OIS (right chart below) has jumped higher once again in response to the latest Fed actions.

All our major growth leading indicators continue to make new lows, with the eurozone and China still mired in recessionary conditions. The US recession model has not triggered yet, but continues to show rising recession risks.

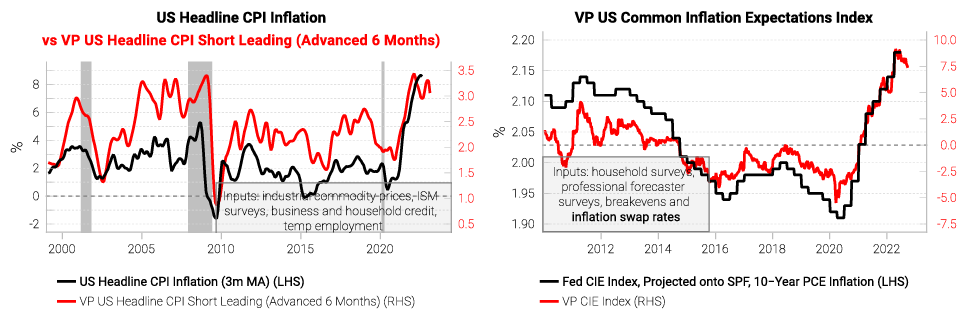

Our US inflation leading indicator stills shows the “inflation plateau” we have been highlighting. An inflation plateau will help to shift the market narrative from “inflation scare” to “recession scare”. This should be supportive for bonds, but not so much for equities. Our inflation expectations indicator, the CIE (right chart below) is also now rolling over slowly, affirming the inflation plateau.

Putting these together, the combination of a) growth LEIs making new lows, b) rising US recession risks, c) other major economies already in recession and d) peaking inflationary pressures are bond bullish. It is likely still too early to position for bull steepening on major policy easing (we are still waiting for a major risk asset crash and/or labor market pain). For now, we still maintain the flattening/inversion bias we have had all year.

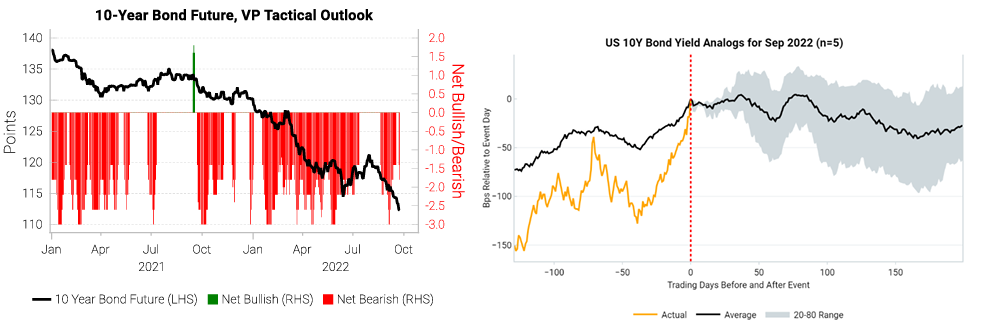

The main challenge to our 6m+ bullish bond view is the tactical set up. On our main tactical context tools (1–3-month trading outlook, left chart below), the trading direction remains bearish bonds (i.e. higher yields). The historical trading analogy finder (right chart below) also sees yields going higher first before plateauing.

Get the full picture at variantperception.com

Nice!!

You write:

An inflation plateau will help to shift the market narrative from “inflation scare” to “recession scare”. This should be supportive for bonds, but not so much for equities.

My own indicators point all toward recession and lower equity markets, too. But I'm somewhat concerned that the ease of the inflation scare might lead to a strong rallye in equities, how probable would you see such a scenario?