Stocks vs Bonds: Revisited - VP May Macro Snapshot

This post is an excerpt from our May 1, 2024 Macro Snapshot report to VP clients. The full length, original report can be viewed here.

Stocks vs Bonds: Structural (2/3y+) outlook favors equity

Structurally (2-3y+ fwd outlook), our thematic work (The Structural Limits of Fiscal Policy, The Age of Scarcity, Portfolio for the High Seas) dislikes nominal bonds and points to financial repression which favors real assets, and by default, equity over bonds.

However, there is another structural positioning/flow issue that will likely continue to drive a “reach-for-yield” / “reach-for-growth” dynamic across asset classes.

Despite higher yields, defined benefit funding ratios (mainly public pension funds) remain well below 100%. There are limited options to close this funding gap, with one solution being to allocate towards growth equities or to reach for yield in private credit.

This structural tailwind for growth equities remains, while at the same time crowding scores for US growth equities are still near the lower end of their 10 year range.

Stock vs Bonds: Cyclical (6-12m) outlook neutral

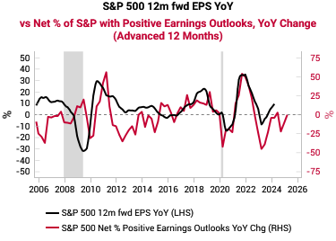

The cyclical (6-12m fwd) outlook for corporate earnings has been surprisingly resilient, defying our previous expectations that rising wage costs would pressure profit margins.

Earnings outlooks have stabilized, while US corporates are starting to show more pricing power.

Our inflation capture decomposition shows whether labor (wages) or corporate profits are capturing the gains from inflation. Even though the period of “greedflation” has been over since 3Q22, inflation is boosting corporate profits once again, while labor is falling behind.

For bonds, yields are starting to rise above our “fair value” estimates (bottom left chart), while term premium is likely biased lower (bottom right chart). This shows that cyclically, bonds also look reasonably attractive.

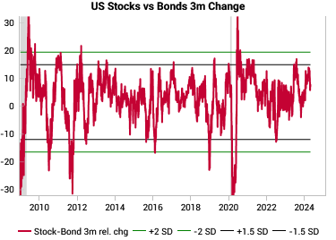

Given the YTD outperformance of equities vs bonds (and over the past 3 years), we think it is better to err on the side of bonds potentially experiencing a cyclical rally. We also think we are currently experiencing a “mini” inflation scare that should peter out through 2Q.

Stock vs Bonds: Tactically Powell tries to short circuit VP Correction Signal

Today’s Fed meeting was widely interpreted to be dovish. The bar to hike is high and Powell has threaded the needle again by talking tough on inflation, while also giving implicit re-assurance he is focused on growth downside risks.

In theory, we are still not fully out of the woods from VP’s Correction Signal Trigger, which usually flags a 30-60 day period of risk-off behavior across markets.

In practice, Powell had every chance today to act hawkish and he refused them all. This likely means the risk-off behavior will be a lot more mixed now, rather than the broad based behavior the signal originally picked up.

Our Fed easing regime model is now back in neutral territory, showing a 40% chance of being in an easing regime.

The trailing 3 month stock-bond ratio still remains near the higher end of historical ranges, suggesting some short-term mean-reversion pressure for equities to underperform bonds.

Positioning wise, CTAs are likely net short equities again, given their beta to the S&P 500 is now negative, which could cause mechanical buying if the risk-on price action from today follows through.

To read the rest of the report, contact us here.