Stylized Post-Crash Patterns After Initial Low

This post was originally shared with VP clients on August 6, 2024.

Summary

When markets crash, they tend to follow a ‘stylized’ pattern of pendulum-like sharp oscillations after the initial low is made.

Typically, we see ~4-8 weeks of price oscillations (large initially, dampening over time) and there is usually a re-test of the initial low at the end before a sustained rally can start.

This post-crash pattern should be used as a guide rather than a foolproof map. Major macro catalysts (e.g. Covid Fed intervention) can invalidate this pattern.

The key takeaway is that the bottoming process usually plays out over a few weeks and investors should expect a high likelihood that the initial lows are tested.

4-8 week post-crash harmonic oscillation + re-test of initial lows

When markets crash, they tend to follow a ‘stylized’ pattern of pendulum-like sharp oscillations after the initial low is made. We re-visit a useful framework to help navigate market crashes: harmonic-oscillation crash patterns. This stylized pattern helps to describe how systems return to equilibrium, like the swing of a pendulum.

Source: spark.iop.org/episode-306-damped-simple-harmonic-motion

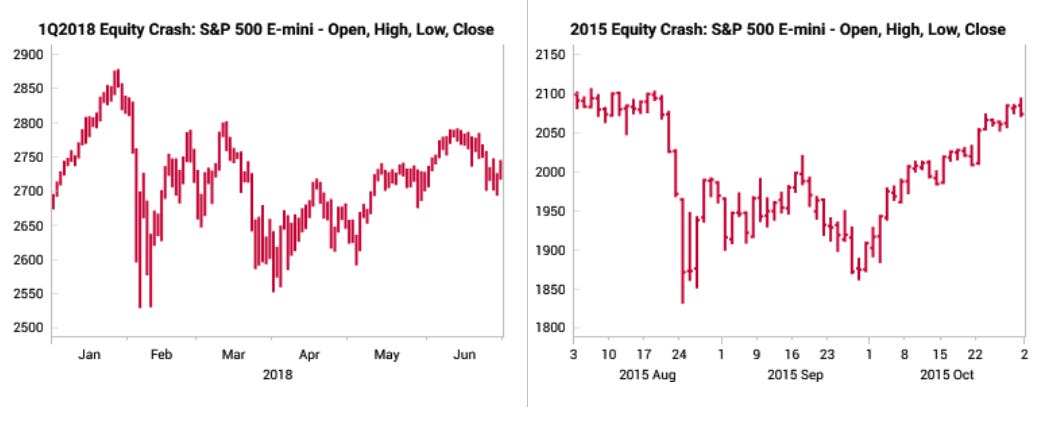

The “yoyo” post-crash pattern results from market participants’ sentiment oscillating wildly, as they take cues from each other. Typically, we see ~4-8 weeks of price oscillations (large initially, dampening over time) and there is often a re-test of the initial low at the end before a sustained rally can start. The below charts shows the 1Q2018 crash and 2015 crash, where the initial low is re-tested after 4-8 weeks.

Similar patterns were also observed in larger market crashes like 1987 and the 2011 crash, where there was also a re-test of the initial low after 8 weeks.

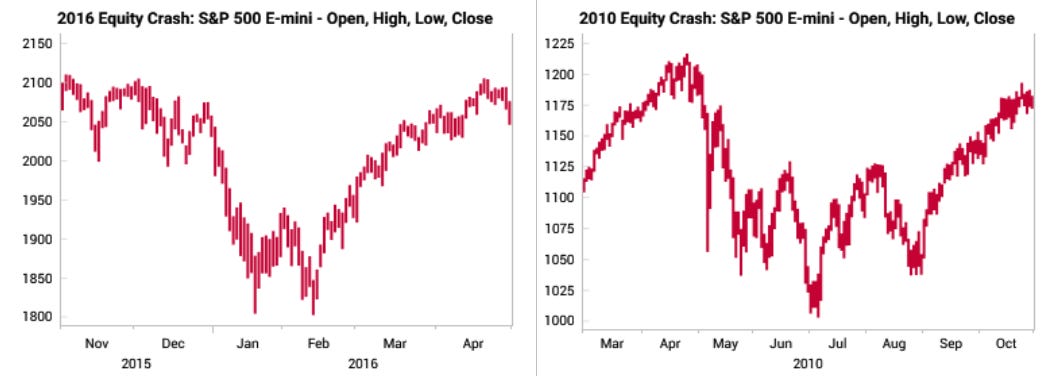

In 2016, the re-test of the low happened very quickly. In 2010, after the May flash crash, the market did go on to make new lows as double-dip recession fears took over. The initial flash crash low was tested multiple times, but the final low was made about 8 weeks after the flash crash.

This post-crash pattern should be used as a guide rather than a foolproof map. The key takeaway is that the bottoming process usually plays out over a few weeks and investors should expect a high likelihood that the initial lows are re-tested.

There are a few examples of when this pattern did not work and it has usually been linked to major macro catalysts (GFC or Fed policy surprises).

In 2008, during the first part of the GFC crash, the 4-8 week pattern of dampening oscillations and a re-test was also observed, although subsequent macro developments resulted in new lows. This is probably not analogous to today as our leading indicators do NOT see the US economy falling off a cliff.

In 2020, the historic intervention of the Fed helped to prevent a re-test of the initial lows, which is very rare historically. Again, this is probably not yet analogous to today. We have yet to see major policy maker panic with emergency rate cuts or reverting back to balance sheet expansion.

In 4Q2018, Powell's comments that policy rates were a “long way” from neutral caused the equity market to crash at the start of October, while the December 2018 Fed meeting drove a further leg down to new lows as the Fed guided to multiple hikes in 2019 to address inflation. In April 2022, the Fed gave a clear indication that the market had under-estimated the Fed's desire to hike rates, resulting in a lower low in equities.

In conclusion, the implication for today's investors is to look for dampening oscillations and a re-test of the initial lows (after 4-8 weeks) as clues that the medium-term bottom is in. The main catalysts that could invalidate this typical pattern would be a major policy surprise from the Fed.

To read more of our research, contact us here.

Excellent analysis! Thank you.