Supportive Growth and Liquidity - Sep. EM/DM Leading Indicator Watch

Weekly Wrap, Sep 19, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Research

Supportive growth and liquidity - Sep. EM/DM Leading Indicator Watch

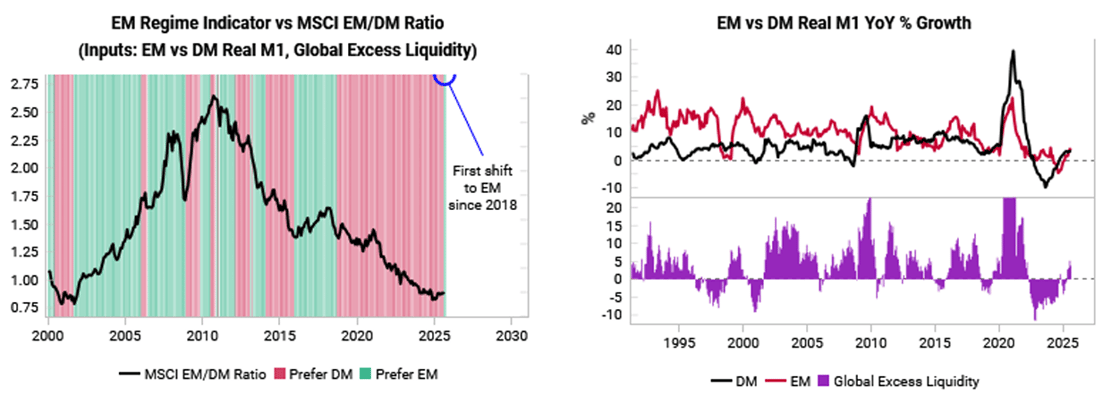

Tailwinds are intact for risk assets from growth, policy and liquidity, and our liquidity-driven regime model still favors EM assets over DM.

Local conditions are starting to matter again as we are seeing divergent leading indicator outlooks within different DM and EM economies.

We are adding short CNHINR based on an LPPL sell signal and the strong cyclical backdrop in India.

UK - Inflation sticky above target but real yields now offer value

Japan - More signs of peak inflation, more yen weakness ahead

Canada - Labor market fears priced in, stick with long CADJPY

New Zealand - Growth and inflation LEI resilient, RBNZ expectations too dovish

India - Strong growth, low inflation => stick with equities, short CNHINR on LPPL bubble

Brazil - Falling inflation and growth headwinds to spur more BCB easing

Indonesia - Growing signs of asset price dislocation amid political tensions

South Korea - Improving growth outlook, but low carry could weigh on KRW

Notes

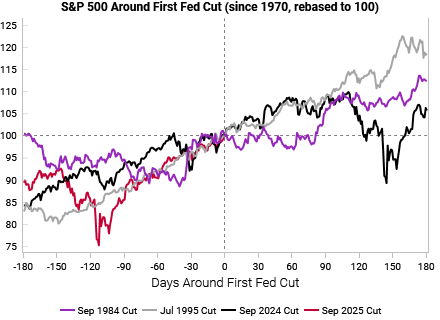

Lessons from previous “no recession” Fed cuts (1984, 1995, 2024)

Asset price behavior after the first Fed cut depends heavily on if a recession materializes or not.

Today, our leading indicators do not foresee a recession, which means the most comparable analogs are the “no recession” Fed cuts in 1984, 1995, and 2024.

The takeaway for today is to expect further gains for equities, a rebound in the dollar, and limited downside for bond yields.