SVB in a leading indicator context

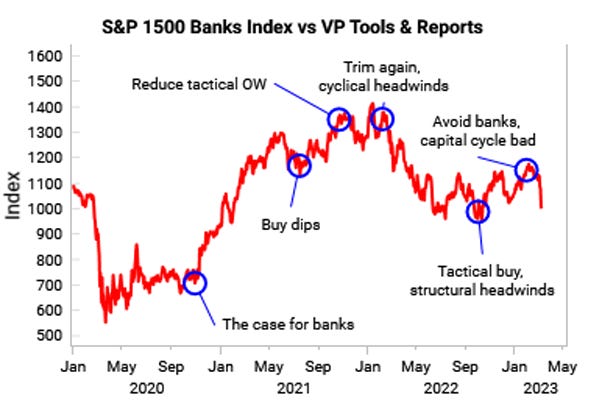

VP’s capital cycle, business cycle and tactical tools have helped time the key turns in US banks. The past 2.5 years have been a great demonstration of the framework in action. The below is an excerpt from our Mar 14th report to VP clients.

We think the most helpful way to think about the exogenous shocks to markets is through the lens of what is the fundamental cause (longer-term buildup of imbalances/excesses) vs the proximate cause (the short-run catalyst that triggers the sell-off).

One illustrative example is the volmageddon episode in Feb 2018. The immediate trigger (proximate cause) for the moves was the release of average hourly earnings which recorded the best gain since 2009, stoking inflation fears. However, the fragility of the system (fundamental cause) was clear through the massive rise in short-vol products.

Today, the proximate cause for SVB’s collapse is the bank run. However, the fundamental cause is that competitive pressures (i.e. capital cycle) had driven US banks to become very capital-abundant amid the post-pandemic boom in deposits, as we headed into an environment of poor liquidity.

Our capital cycle framework captures the underlying competitive winds within an industry. Banks outperform on a 2-3y horizon when competition is limited and the business cycle is holding up. We measure bank industry competition using loan-loss provisions and ROE.

US banks first turned capital-abundant in 2H22 as banks started to increase loan-loss provisions and ROE started to dip from elevated levels; this suggests that banks had been over-earning with the initial surge in deposit monies, and were set to underperform on a 2-3y horizon as competition increased for fewer deposits.

The below shows the recent timeline of VP’s US banks work, using a blend of: tactical (1-3 month buy/sell signals, flows), cyclical (6-12 months growth, liquidity, recession), and structural (2-3y+ capital cycle) indicators.

Below are the key VP reports and quotes on US banks investing:

Avoid banks (30th Jan 2023). Banks are capital-abundant and the US economy is likely at the start of a recession.

“US banks have dropped sharply down the capital-cycle ranks. Loan loss provisions are rising from low levels, and ROE is set to keep falling from elevated levels as the downturn gains traction.”

We also flagged fundamental tech vulnerabilities in Oct 2021, flagging software capital-abundance and margin compression risk. The capital cycle has continued to worsen for software.

Tactical buy on banks (Oct 2022).

“US banks: tactical tailwinds + structural headwinds. US banks is an extreme outlier based on flow data and most vulnerable to a flow reversal. But our structural capital cycle indicators suggests banks are set to underperform on a 2-3 year outlook.”

Reduce overweights in banks (Feb 2022)

“US banks are now less exposed to flattening yield curves, but higher valuations are a concern.”

Buy the dip in US banks (July 2021)

“Our selling exhaustion signal has triggered for banks, while credit cycle and growth indicators are still strong, which should support tangible book growth.”

The case for banks (Oct 2020)

“US financials look like great contrarian long opportunities.” “In today’s environment, we see that profitability (measured using revenue to assets/risk-weighted assets) is at the low end of US banking history.”

Get the full picture at variantperception.com