The great BoJ divergence

The Bank of Japan’s ultra-dovish policy stance looks increasingly out of step with other central banks and Japan’s own inflation data. The BoJ renewed its commitment to ultra-low rates and defending the yield cap in yesterday’s meeting, following an attack on JGB futures that triggered the exchange’s circuit breaker on Wednesday.

We previously flagged shorting JGBs to express our skepticism with an ultra-dovish BoJ. The below is an excerpt from our May 19th Leading Indicator Watch, highlighting the drivers of the great BoJ divergence.

We remain skeptical of the BoJ’s commitment to ultra-dovish policies, especially in light of rising inflation.

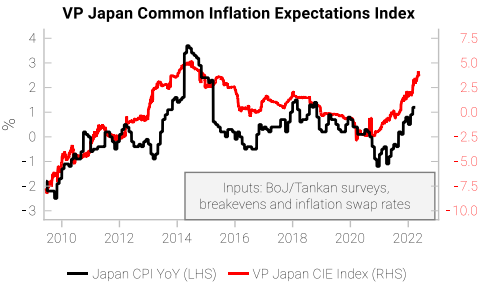

The chart below shows our Japan Common Inflation Expectations (CIE) Index is still surging. The CIE aggregates survey and market measures of inflation expectations. The Japan Tankan inflation survey is back at the highs seen in the 1970s and 80s.

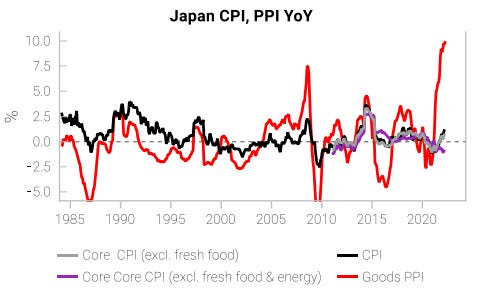

Japan’s PPI hit 10% YoY in April, far above CPI, and indicative of pent-up cost inflation pressures and upside inflation risks. Core CPI, which the BoJ is supposed to target, includes energy in Japan. Core-core CPI in Japan excludes both food and energy.

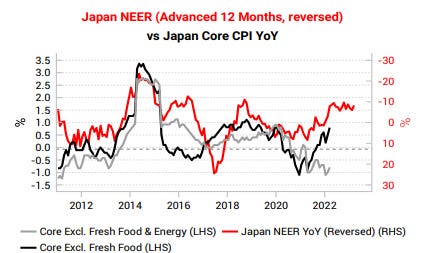

The speed of the USDJPY surge could also exacerbate inflation risks and start to shift public perceptions of prices. For example, Japan’s largest brewer Asahi has announced its intention to raise prices, including its flagship Super Dry, Japan’s best-selling beer.

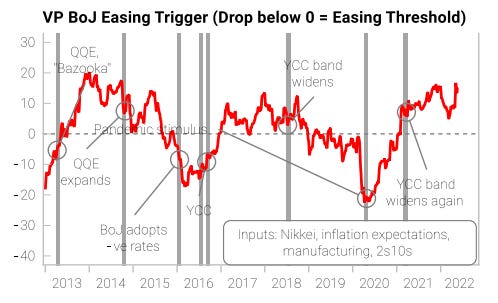

We try to quantify central bank reaction functions using measures of economic and market stress. Refreshing our BoJ easing trigger, we remain far above “dovish” policy territory. Conditions are actually more loose than the levels at which the BoJ previously widened its YCC band in 2018 and 2021.

Get the full picture at variantperception.com