The Last Mile - Excerpt from VP November DM Leading Indicator Watch

This post is an excerpt from our Nov 17th report to Variant Perception (VP) clients (link to original report), digging into lesser-followed country-specific themes across DMs.

Australia: soft-landing playing out

The Aussie soft landing first discussed in our Sep Leading Indicator Watch (link) is playing out. Both our growth and inflation LEIs have bottomed. The RBA is one of the few major central banks still in a hiking regime.

The RBA raised its policy rate by 25bps at its November meeting following a four month pause. Guidance noted the potential for more hikes on the back of CPI and GDP estimates being revised ~50bps higher for 4Q23.

Our RBA regime model (below chart) – which incorporates both market (REER, yield curve) and economic (commodity prices, CPI, global risk, housing) inputs – suggests further hikes are justified.

Despite decade-high interest rates, consumer sentiment towards purchasing a home has sustained its rebound off the lows (below chart). Sentiment tends to lead home prices by 12 months, putting further pressure on the RBA to maintain restrictive policy.

Capacity utilization rates have started to pick up again corroborating the low unemployment rate (below chart).

Japan: JPY breadth confirms depreciation in contrast to late 2022

The impossible trinity problem continues in Japan. JPY breath vs G10 FX still shows USDJPY tailwinds, in contrast to late 2022.

Our Japan inflation LEI remains elevated relative to broader global disinflation trends (below chart).

The Summary of Opinions from the October BoJ meeting shows a more confident tone. It indicates that the BoJ is increasingly focusing on suitable policy adjustments in response to rising wage growth and evolving inflation expectations. In other words, they are acknowledging that they are entering a world where interest rates exist.

Our BoJ hiking regime model (below chart) still confirms the need for a tighter monetary policy.

Strong underlying wage growth and elevated consumer inflation expectations (below chart) confirm the need for Japanese yields to rise.

JPY breadth vs G10 FX confirms that JPY depreciation pressures remain. This is different to late 2022 when breadth was muted even as USDJPY rallied (below chart).

UK: disinflation becomes consensus, waiting for the next divergence

The easy money has been made on the UK disinflation story. Services inflation surveys are ticking up again (below chart).

Back in the summer, the UK disinflation trade was NOT consensus, creating great risk-reward for our Sonia vs Euribor (link) and short GBPAUD (link) trades.

Today, the UK opportunity set is much less compelling. UK equities are cheap, but value funds have maintained big UK overweights.

GBP 2s10s 1y and 2y forwards have relentlessly steepened since the summer with the 2y forward now un-inverting (below chart). Again this seems somewhat fair given the BoE hiking cycle is likely over, but the BoE still wants to maintain some inflation credibility (Link to BoE's Pill says high inflation is still main risk for UK).

Our UK growth LEI has bottomed but remains at very low levels. The UK recession is also now more broadly discussed in mass media (link, link).

The next UK opportunity will likely be a long GBP expression. Our 12m forward FX edge model for GBPUSD (link) is seeing more edge to being long GBP. We are waiting for the next bullish GBP tactical model trigger.

Norway: inflation breadth still elevated

We remain intrigued by Norway’s inflation dynamics that could translate into a contrarian short EURNOK trade. For now, our 12m forward FX edge model for EURNOK is still very bullish, which tempers our conviction.

We first noted in our September Leading Indicator Watch (link) that Norway’s inflation leading indicator is much stronger than other G10 countries. This is being driven by NOK depreciation resulting from the Norges Bank FX purchase policies.

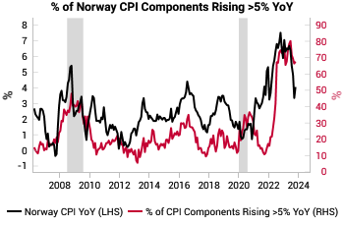

EURNOK has rallied further in the past 2 months, largely thanks to some downside inflation surprises (above chart). However, inflation breadth remains elevated (below chart), where a large majority of the CPI basket is still rising at 5% YoY.

We also suspect the rollover in services CPI will take longer. The below chart shows that Norwegian business wage expectations lead the services CPI.

The tail risk remains that the inflationary pressures facilitate a shift (perceived or real) in Norges Bank FX policy, which would allow some catch up NOK appreciation.

For now, our 12m forward FX edge model for EURNOK is still very bullish (link), which tempers our conviction on the short EURNOK trade outright. But put-spreads could be a reasonable expression.

Great post, thank you.