The Last Mile - Excerpt from VP November EM Leading Indicator Watch

This post is an excerpt from our Nov 17th report to Variant Perception (VP) clients (link to original report), digging into lesser-followed country-specific themes across EMs.

Mexico: political risk unlikely to derail longer-term outlook

We still view Mexico and LatAm in general as a good structural bet given attractive capital cycle dynamics. Political risks remain but are likely overstated given AMLO’s track record.

Banxico held rates steady at 11.25% at the November meeting. Our Mexico inflation LEI ticked up marginally this month, but is still supportive of broad based disinflation.

This year has seen a large divergence between our Mexico growth leading indicator and the strong realized economic growth. We think this largely reflects the structural near-shoring trend benefiting Mexico.

Growth is led by robust private consumption and investment, with notable strength in service sectors, construction, and auto production. This has led to record-low unemployment rates and record-high manufacturing capacity utilization rates.

Uncertainty about trade had been a risk, but completion of the USMCA has provided reassurance. However, uncertainty over other govt policies has exerted restraint; AMLO’s recent increase in tariffs for non-government airport operators led to a major equity sell-off.

The motive seems isolated in our view as AMLO is trying to re-coup the huge amount of money that was written off when he cancelled CDMX's Texcoco airport in a *purely* politically motivated move.

Brazil: slight shift in BCB tone, but cuts still base case

In Brazil, our growth LEI has bottomed, but is yet to turn up. Inflation has bottomed, but remains low overall.

In its November meeting, the Brazilian Central Bank stressed the long journey to return inflation to target. Mounting global risks have shifted the tone of the BCB slightly more hawkish.

Increasing food and beverage prices (>20% of CPI basket) are an upside risk to inflation. Our Brazil Custom Food Index is bottoming, and tends to lead food & beverage CPI by 6 months.

Nonetheless, core-inflation trends remain firmly disinflationary. The Selic rate spread to CPI remains historically elevated. The continued 50bps cadence of cuts remains our base case.

Brazil's substantial trade surplus this year, driven by a steady increase in agricultural exports, is not a one-off event but a sign of a structural shift in global trade patterns.

Political risks remain. Following a couple of weeks of negotiations, Senators approved the tax reform proposal. While not perfect, this tax reform is a step up from a highly burdensome system, but its extended transition period (if approved, likely by YE 2023) brings short-term uncertainties.

India: elections due Q2 2024

Our India growth LEI continues to rise. Elections are due in Q2 2024.

Our Inflation LEI remains firmly in a downtrend, but repeated supply shocks paired with stable growth could keep inflation above the 4% mid-point of the RBI’s target range.

We continue to monitor rainfall and various agriculture prices. Tomato prices have sharply corrected lower, but now seasonality shifts focus to onions, whose prices have begun to surge.

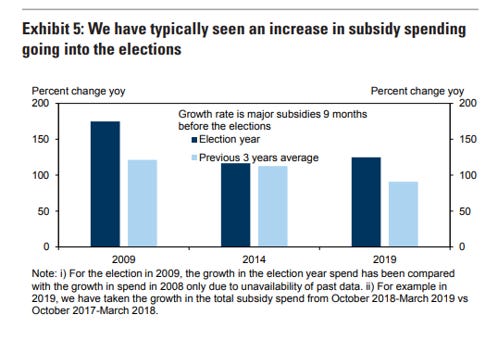

The government could intervene through subsidies, etc. to keep a lid on food price inflation, especially heading into an election year (below chart source: Goldman Sachs).

Higher oil prices, slower growth in trading partners, and steady domestic growth is likely to increase the current account deficit in 2024.

While services exports have likely peaked (as a % of GDP), they will continue to cushion a wide goods trade deficit. Foreign portfolio inflows from India’s inclusion in JPM’s global bond index should help fund the current account deficit.

South Korea: inflation risks amidst equity intervention

Our Korea inflation LEI suggests cyclical disinflation trends are in place, but inflation breadth has picked up.

The latest Bank of Korea minutes revealed a modestly hawkish shift. Two members advocated for stronger measures: one proposed a preemptive rate hike, and the other suggested a more aggressive tightening stance than previously planned, both due to rising inflation risks.

Inflation breadth jumped in October, suggesting the uptick in headline CPI was not a one-off exogenous shock.

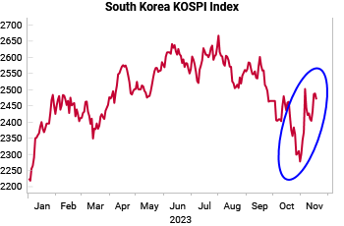

South Korea’s ban on short selling until June 2024 (elections) led to a surge in the country's stock market, benefiting sectors like batteries and chipmakers.

Interestingly, it has pushed Korean equities up through key resistance. We calculate bottom-up T1Y and T3Y VWAPs to find major support/resistance levels. By definition, these bottom-up VWAPs are the price at which the average investors got long if they bought in the past year or past 3 years.

While the ban boosts short-term market confidence, it poses long-term concerns for market health and fairness, and may hinder South Korea's recognition as a developed market by global index providers.

Great post. Regarding Mexico's resilient industrial production: a large part of this has to do with Tren Maya (the large infrastructure project on the Yucatan peninsula). Just a bit more context.