[Thematic] - The Primacy of Sovereignty

Weekly Wrap, Dec 5, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

[Thematic] - The Primacy of Sovereignty

Accelerating mobilization in US policy echoes McKinley, FDR, and Eisenhower.

If it continues, geographical, industrial, and technological priorities will dominate the investment landscape, not “market forces”.

The takeaway:

Historically, geopolitical rivalry has spurred a rapid, large-scale and sustained US response

Investing alongside the pillars of sovereignty will continue to provide a durable opportunity set well beyond AI

Industrial policy + fiscal-monetary policy co-ordination requires selective equity exposure, alternative “safe-havens”, and real assets over nominal bonds.

2025 Recap: Everything Everywhere All at Once in 2025

Cyclical Asset Allocation: Macro Risk Indicator remains in “risk-on” territory

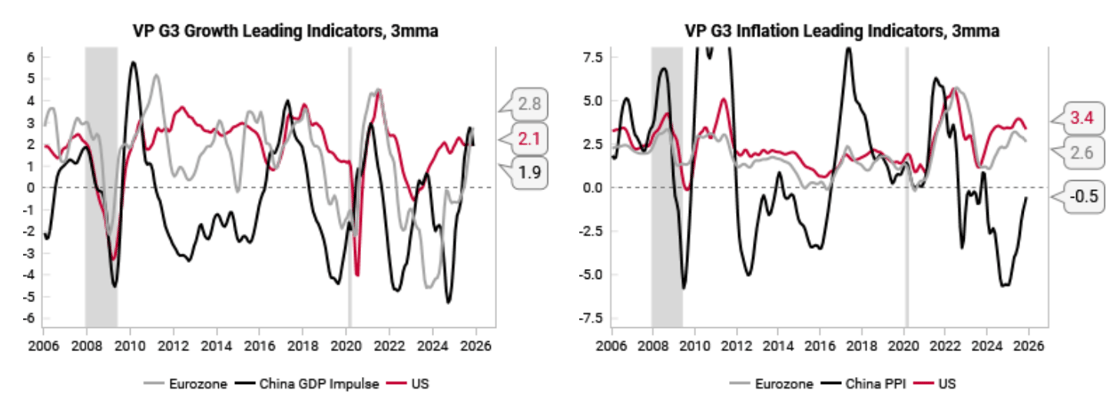

Leading Indicators: LEIs paint a picture of resilient growth and inflation rolling over

Structural Asset Allocation: Financial repression, high valuations, changing profit drivers, high real yields

Volatility: Don’t forget to look for opportunistic long vol hedge.

#1 Trump’s capex boom arrives a year late, broadens beyond AI

#2 US growth surprises to the upside despite muted labor market

#3 Housing disinflation breaks sticky inflation narratives

#4 US 10y yields go nowhere, trades in a tight range around 4%

#5 Value equities outperform growth

#6 G10 FX divergence: Apac (AUD & NZD) over Europe (EUR & GBP)

#7 EM equities outperform DM, led by Brazil

#8 Oil trades below 50 and above 75 at some point during the year

#9 China tech stocks outperform US tech stocks

#10 Capital Cycle: US regional banks & energy services outperform