Tools that have helped us the most #2

This is the second post in a series where we share the best tools and principles that have helped us understand the business cycle. The second tool below is our Recession Signal - excerpt from the VP Cookbook, June 2021.

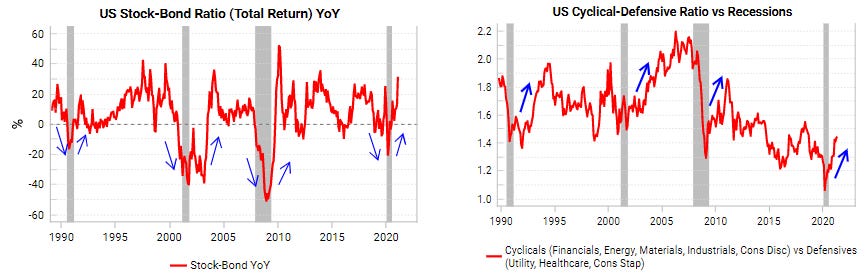

Getting recessions right in real-time is one of the most important ways for investors to protect capital. Recessions are non-linear processes that represent a regime change in the economy and markets. When economic stress and market stress occur at the same time, they often get caught in a feedback loop that very quickly tips the economy into recession.

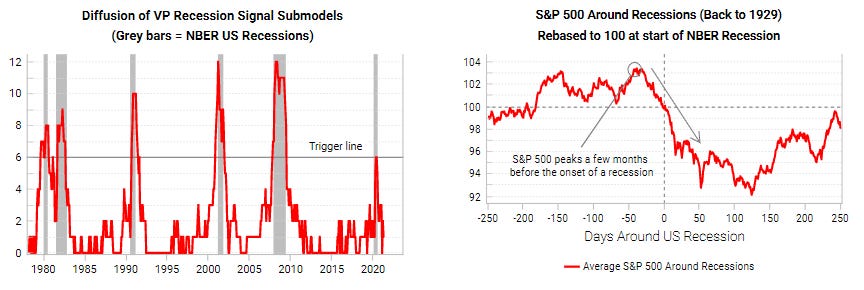

Our Recession Signal gives a 3-4 month lead on recessions. No single variable or theory can explain every downturn, so we check the pulse of a range of market data (eg credit spreads) and economic data (eg truck orders). If enough data is stressed at the same time, this tells us we are on the cusp of a recession. The largest drawdowns to equity portfolios always happen in recessions.

Calling the end of recessions in real-time helps us to buy dips aggressively as the post-recession regime ushers in a new bull market.

Get the full picture at variantperception.com