Understanding VP Fast Money

Not all price action is equal. VP Fast Money is a real-time, daily proxy of speculative investor activity.

This post was originally shared with VP clients on January 12, 2024.

Different profiles of investors

Market participants behave differently when executing trades. Some are more speculative while others are more conservative. Quantitative and behavioral factors influence this behavior, such as investment strategy, fund size, time horizon, greed, and loss aversion.

It should be observed that three classes of men are to be distinguished on the stock exchange. The princes of business belong to the first class, the merchants to the second, and the speculators to the last. - Joseph de la Vega, Confusion of Confusions

VP Fast Money is a contrarian indicator that identifies extremes in speculative investor behavior. We can determine whether “impatient” (speculative) or “patient” (conservative) investors are driving market behavior because not all price action is equal.

Our definition of speculative investors focuses on time horizon. Investors with shorter time horizons are generally more impatient because their alpha is fleeting. Speculative investors are more likely to cross the bid-ask spread to ensure trade execution and their desired exposures are achieved.

Patient investors with longer time horizons prioritize entry points over exposure on any given day. They tend to sit further back in the order book, using tactics such as out-of-the-money limit orders to put on positions after big market moves.

Patient investors provide trading liquidity and add depth to the order book. On the other hand, speculative investors consume trading liquidity because their orders crossing bid-ask spreads are executed immediately against the best available limit orders, decreasing order book depth.

A common adage is that volatility is the price of trading liquidity. Volatility results when there is an imbalance between a) supply and demand of trading liquidity or b) orders that cross the bid/offer spread and order book depth. Therefore, when speculative investors dominate daily trading volumes, we observe higher realized volatility. This allows us to infer speculative investor involvement in markets by looking at volume, volatility expansion, and price moves. The more volatility expands in the direction of the price move, the clearer it becomes how speculators are positioned.

A real-time proxy of sentiment

A plethora of investor sentiment surveys aim to provide insights into whether speculative investors are driving price action, but these surveys are usually released infrequently and with a lag. VP Fast Money is a real-time, daily proxy of speculative investor activity.

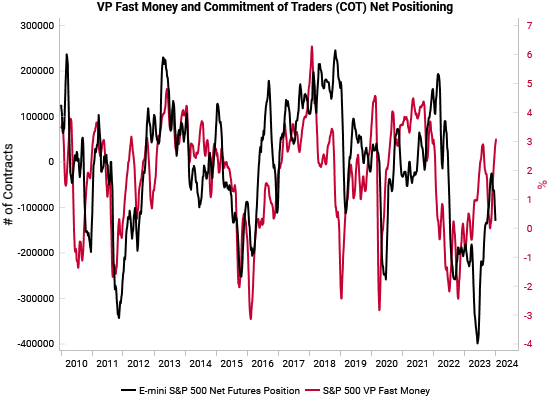

For example, a commonly cited measure of speculative behavior is the net futures positioning data from the CFTC's Commitment of Traders report. However, the COT data is released with a delay and only covers a few major indices / assets. VP Fast Money removes these limitations, allowing us to see speculative investor behavior within almost any traded market in the world in real time.

Identifying tops and bottoms

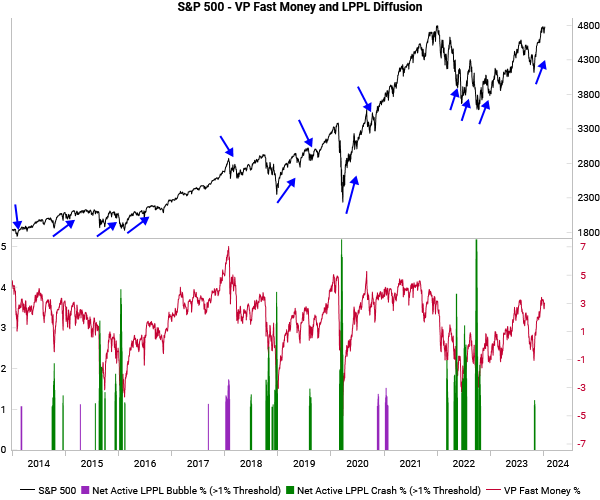

When price is overlaid with VP Fast Money, a clear trend emerges. Rallies fueled by speculative trading often lead to sharp corrections. Conversely, material sell-offs that coincide with declining speculative activity create attractive entry points. Below is the standard VP Fast Money chart that can be found on our portal.

Backtests empirically show that extremely high VP Fast Money leads to negative forward returns, while extremely low VP Fast Money leads to positive forward returns on a 1 and 3 month basis.

As laid out in our Tactical Cookbook 2.0, VP's tactical tools utilize very different methodologies that complement each other while being uncorrelated. A confluence of indicators usually flag more attractive setups.

VP Fast Money captures extremes in investor behavior by analyzing flow data. Our LPPL Climax signals flag extremes in investor behavior by analyzing price patterns to determine when opinion has become highly uniform (link to Understanding LPPL whitepaper). Together, these two indicators provide a powerful signal of whether extreme investor behavior is driving price action. Below, VP Fast Money for the S&P 500 is overlaid with a diffusion of LPPL Crash and Bubble signals of all underlying S&P 500 stocks. When VP Fast Money is extreme and LPPL signals are active, as the blue arrows show, this combination is historically successful at pinning tops and bottoms.

Like most contrarian, mean-reverting signals, VP Fast Money will perform worse in highly trending markets. Tactical tools are best used as complements to one another and in the context of a cyclical and structural framework.

Asset Class Examples

Commodities

FX

Rates

Single-stocks

Crypto

For more insights into our investment framework, visit our website.