Unleashing the dragon: tactical buy signals in China equities

The post below is based on our note to VP clients on July 12th.

In June's Macro Snapshot, we laid out the key tactical indicators for buying China equities to confirm the short squeeze potential. It's arrived.

Autocorrelation Signals: Quantified Capitulation

Autocorrelation signals are currently flashing across China's equity indices. These trigger when the most underperforming stocks of the past year are also those of the past week. This extreme capitulation is often a strong contrarian buy signal.

Cumulative flows for China's large-caps are at near rock bottom. They were only lower during the 20th Party Congress amid an LPPL crash. LPPL = Log Periodic Power Laws popularized by Didier Sornette.

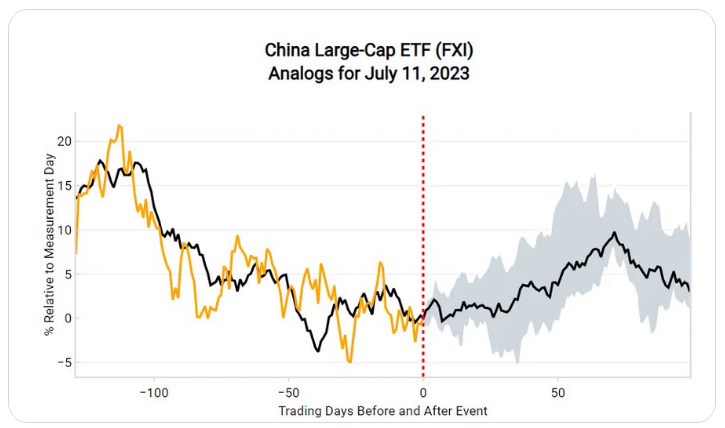

Historical price analogs for these large-caps suggest a multi-week short squeeze may be imminent. And our cyclical view of China shows “trapped liquidity”.

China's 'Trapped Liquidity' Phenomenon

Trapped Liquidity = Monetary stimulus fails to benefit the real economy and instead propels asset prices. This trend has been on the rise as weak inflation and real growth press the authorities into action.

What are China's policy responses like? They tend to be more gradual than the Western "shock-and-awe" easing. Brace yourself for a prolonged easing cycle with a mixed bag of thrills and letdowns.

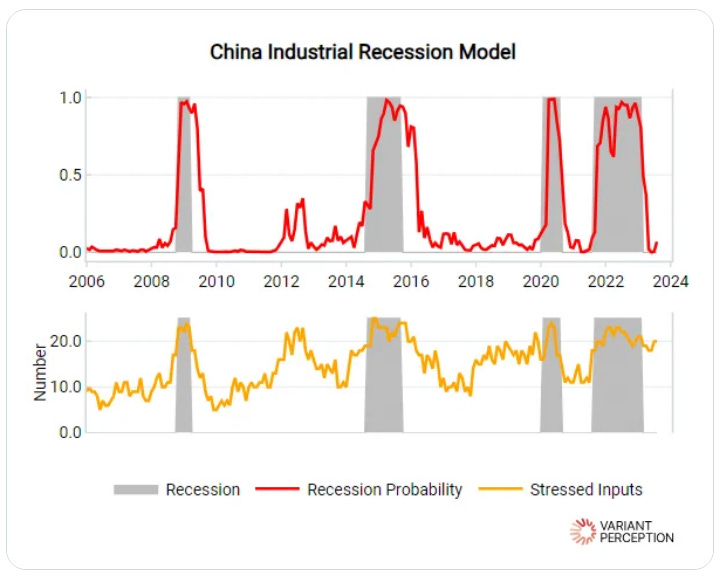

As of April, our China recession model's probability dropped to zero... signifying an exit from recession. But the recovery isn't stellar, far from it. China's transition is from "very bad" to "bad", and external headwinds continue to dampen our China cyclical LEI.

Besides, the real estate sector is still underperforming. Weak local government land sale revenues YTD = shortfall needs to be offset by increased debt issuance. The stimulatory effect from this is likely minimal, barely compensating for the revenue downturn.

Riding the Wave of Chinese Equities

So if "housing is for living in, not for speculation"... then equities naturally become the recipients of excess liquidity as onshore yields decrease. Considering these dynamics, we think it’s time to buy Chinese equities.

As always, the dynamics we've outlined are part of a complex picture, see our full range of China tools at: https://portal.variantperception.com/charts

Very interesting. So large caps like BABA and JD ?