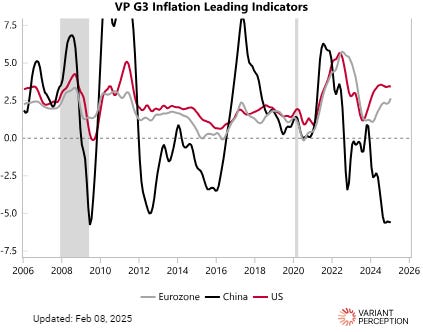

Updated LEIs still point to upside inflation surprises, mixed growth

This is a Note originally shared with VP clients on February 4, 2025. The original Note can be viewed here. To gain access to more of our research, contact us here.

The uptick in our inflation diffusion index means that the current mini-inflation scare will likely persist for the next 3-6 months, although we don't yet see enough evidence for a second wave (or renewed hiking cycles from central banks). Meanwhile, US growth remains a positive outlier in an otherwise mixed global growth picture.

Our global diffusion of inflation LEI inputs has reached its highest level since 2021, implying likely upside inflation surprises in the short term.

Our interpretation of the indicator is that it corroborates our view that inflation is likely to remain sticky above central bank targets. Our LEIs suggest this is the case in the US and Eurozone.

To be clear sticky inflation does not mean a second wave (yet). Let's see how the data evolves in the coming weeks and months.

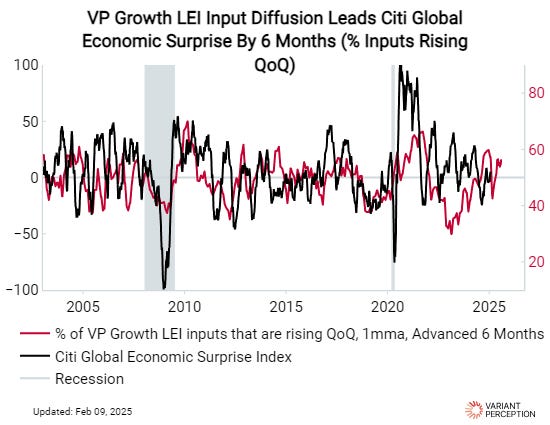

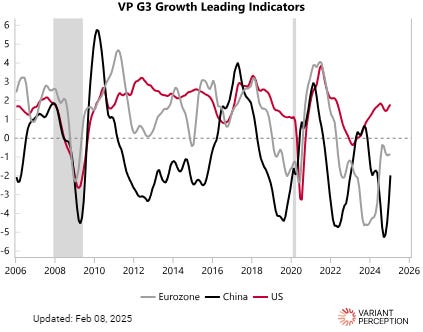

On the growth front, there hasn't been much change since last month: growth is mixed, but there are divergences under the hood (e.g., downside risks in the UK and upside risks in New Zealand). Our global diffusion of growth LEI inputs shows just over half of the inputs are rising QoQ, which also points to rising commodity prices.

The US remains the clear growth outlier among the G3. As we noted yesterday, we think this relative strength of the US gives the Trump administration more bargaining power in trade negotiations and will encourage more tariff threats.

Our new chart collections feature on the VP portal lets you easily see all the indicators we are tracking. To gain access to all our chart collections, contact us here.

While I agree that a second wave of inflation is unlikely, we should be aware that spot rents (Both S&P Case Shiller and Zillow Rent Index) show a persistent re-increase in rents since 4Q24. If we assume that spot rents have a 12-month lagged effect on inflation data, the 2nd half of 2025 should see some inflationary pressure.