US Inflation; Global Imbalances; 1980s Accords

Weekly Wrap, Aug 15 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Weekly Wrap - Aug 15

First signs of tariffs in July inflation data, but no need to over-react

With all of the key July inflation data released, we are seeing the first evidence that tariffs are starting to flow through to prices.

Underlying leading indicators do not point to a large or sustained tariff impact. With only about three Fed cuts priced in by March 2026, we think the risk-reward still favors betting on more Fed easing as the US labor market slows and housing remains weak.

Read our latest thematic (for VP Clients only).

[Thematic Extract] Global coordination: Reagan and the Plaza and Louvre Accords

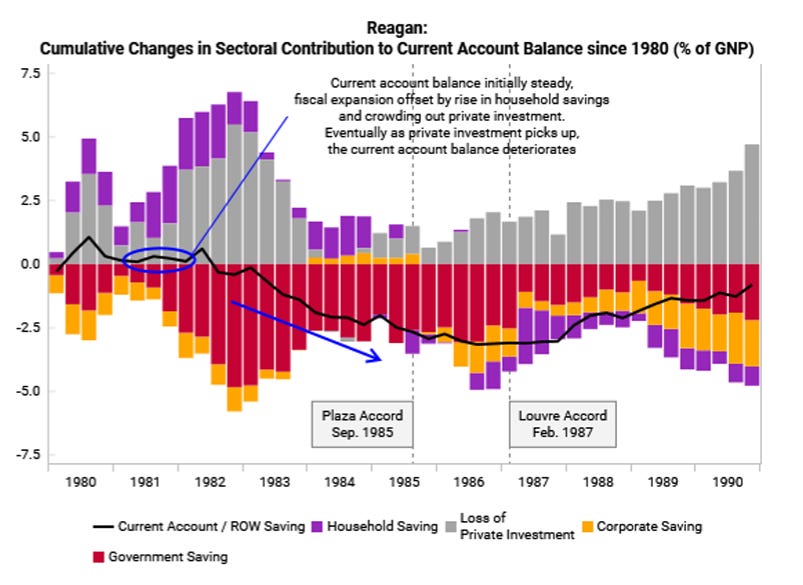

In the 1980s, coordinated currency and fiscal policies between major economies were the main way to resolve imbalances.

Plaza Accord (1985): weaken USD to correct large trade imbalances and stimulate global economic stability.

Louvre Accord (1987): stabilize currency markets through coordinated fiscal policy adjustments.

These were the consequence of imbalances from Reagan’s first term. Back then, the current account balance initially stayed steady, with fiscal deficits offset by rise in household savings and crowding out.

From 1983, the fiscal deficit shrank and the rebound in investment and fall in household savings drove most of the deterioration in the current account deficit. Ultimately, imbalance was corrected by fiscal consolidation and large decline in investment.