US labor market review: the good, the bad, and the ugly

Monthly Wrap, August 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Monthly Wrap - August 2025

VP Monthly Flagship Reports

The burden of proof - August Macro Snapshot (Aug 1)

Ugly NFP data crystalizes Q3 US growth scare we warned about. Balance of data still points to slowdown, not recession.

We see most global central banks easing policy and recovery in our Eurozone and China LEIs. This has pushed our cyclical Macro Risk Indicator into “risk on”.

Macro Risk Indicator was NOT designed to capture shocks like tariff costs. Therefore, we are waiting for more data during seasonally weak Aug-Sep periods before overweight risk assets.

For now: balanced allocation, prefer TIPS (vs nominal bonds) and large caps (vs small caps).

Bending but not breaking - August G3 Leading Indicator Watch (Aug 8).

Highest US tariff in a century has stalled US job growth without (yet) broader layoffs or higher prices. If the labour market holds, we would look to add risk assets in coming months given favorable global liquidity backdrop.

US: Most coincident data resilient despite weakening labor market. Base case: “muddle through” until data proves otherwise.

China: LEIs improving, but weak housing market and other structural headwinds mean no major reflation on the cards.

Eurozone: More signs of growth rebound, but real yields still high as inflation rolls over.

Cyclical factors align for EM outperformance - Aug. EM/DM Leading Indicator Watch (Aug 21)

EM economies are driving improvements in global growth and liquidity. Inflation LEIs are edging lower for most major DM/EM economies.

Tailwind for risk assets intact as synchronized global easing cycle broadens out. Our liquidity-driven regime model now favors EM over DM equities for the first time since 2018.

We reiterate our long exposure in Brazilian and Indian equities; long KRW (vs CNH) and long CAD (now vs JPY); and long 2-year UK bonds. We are adding short AUDUSD based on tactical and cyclical model alignment.

Most Read Notes

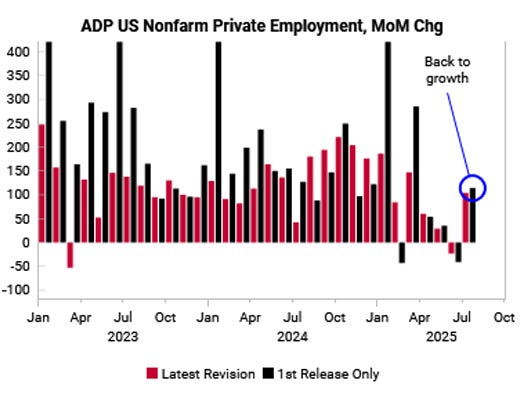

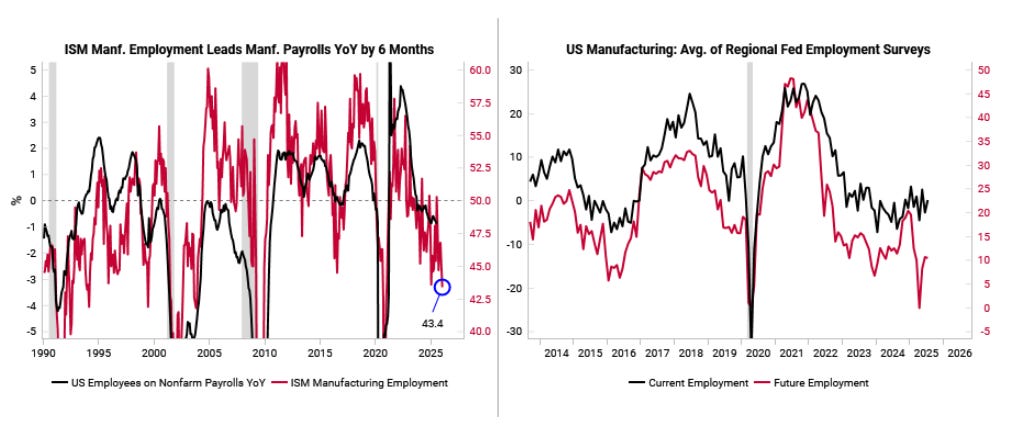

US labor market review: the good, the bad, and the ugly (Aug 5)

US labor market slowing to a crawl, but we are not yet seeing recessionary feedback loops.

Good: Levels and breadth of layoffs still limited

Bad: Coincident and leading data point to continued weakness

Ugly: Manufacturing and residential construction job losses gaining pace

From here, key downside risk to US labor market is tariffs hurting corporate profit margins, which could lead to broader layoffs. Burden of proof is on evidence of further worsening.

Waiting to embrace "risk on" - August Big Picture Call [video + AI summary] (Aug 7)

US labor market cooling, and key risk is that tariffs hit corporate margins and spur broad-based layoffs. So far, this is not the case and with most coincident data resilient. Our base case is that the economy will muddle through.

LEIs for China and the Eurozone are improving.

With broader growth and global liquidity backdrop favorable for risk assets, we are waiting for confirmation from August labor market data before fully embracing “risk on” asset allocation.