US labor market: what's different this time?

This post is an excerpt from our June 19, 2024 Portfolio Watch report to VP clients. The full length, original report can be viewed here.

Full report summary:

The dog that didn't bark: US jobless claims vs fiscal deficits

Handicapping the risks between moderate labor deterioration and the benefits of a profit recovery

Cyclical wage growth to stabilize around 4-4.5%

Structural changes in job openings & participation rates => risks NAIRU under-estimated similar to the late 1960s

Negative QCEW data revisions: a hollow victory rather than the Wile E. Coyote moment

The dog that didn't bark: US jobless claims vs fiscal deficits

Labor market data is well-known to be a coincident / lagging indicator of the economy. However, there are clearly times when it matters. The main reason to care about labor market data is that it is usually the final shoe to drop before a recession.

Typically, there is an initial period of deterioration in credit and credit-sensitive leading indicators, which provides the vulnerable environment for negative feedback loops to kick in when layoffs rise. This negative feedback typically involves rising layoffs causing a fall in consumer incomes, which drag down corporate profits, resulting in even more layoffs. This is the essence of recessions and what drives large asset price drawdowns.

HOWEVER, since the start of 2023, these negative feedback loops have been short-circuited by persistent fiscal deficits, which has helped to buffer profit margins and support employment. We have previously described US fiscal policy as resembling Sisyphus rolling the boulder up the hill, offsetting the negative drag from the private sector and propping up the economy. This continues to be visible in the data.

Employment growth in government and education & healthcare services (heavily influenced by governments) has been robust since January 2023, in addition to accounting for large weights in overall employment.

Another way to show the impact of fiscal policy is via the Kalecki-Levy profit decomposition. The last 18 months has been characterized by the unprecedented combination of very large deficits and low household savings, which has helped to prop up profit margins.

This fiscal backdrop has kept the typical negative feedback loops between credit, incomes, profit and jobs at bay. Since 2023, there have been numerous data points showing marginal deterioration in job market data, but none of these followed through into a broader negative feedback loop.

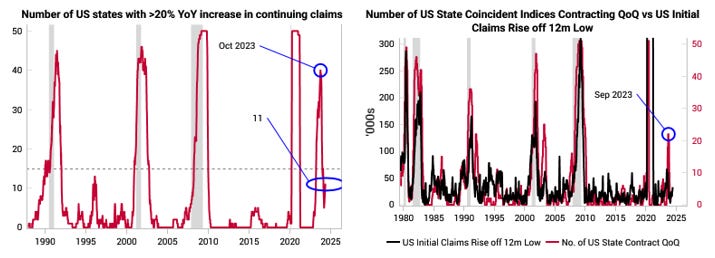

For example, both US initial claims and continuing claims rose 20% off the lows without causing a recession, a first in history (left chart below). The absolute level of jobless claims have also remained low despite weaker private hires data (right chart below).

At the peak, 40+ US states saw their continuing claims rise more than 20% YoY, yet this did not translate into a recession (left chart below). Historically, such high levels of stress across states has only been seen near the end of recessions rather than the start. Similarly, at the peak 20+ US state's economies were contracting QoQ, yet this did not result in a broader negative feedback loops (right chart below).

To read the rest of the report, contact us here.