US resilient, China stalling, Eurozone edging higher - Nov. G3 Leading Indicator Watch

Weekly Wrap, Nov 14, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

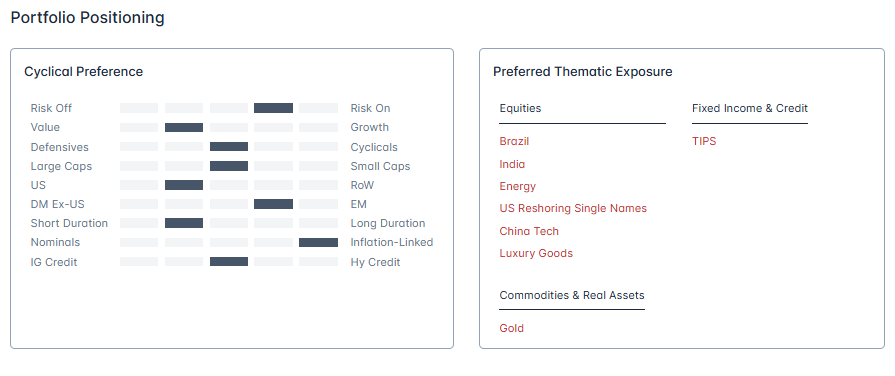

Find our investment ideas/portfolio positioning by time horizon. All linked to reports and charts.

Or review our top global macro trading ideas by asset class. Primarily rates and FX focused, with opportunistic equity trades.

US resilient, China stalling, Eurozone edging higher - Nov. G3 Leading Indicator Watch

Balance of shutdown data confirms resilient US economy. Cyclical roadmap: Fed still easing into elevated nominal GDP growth.

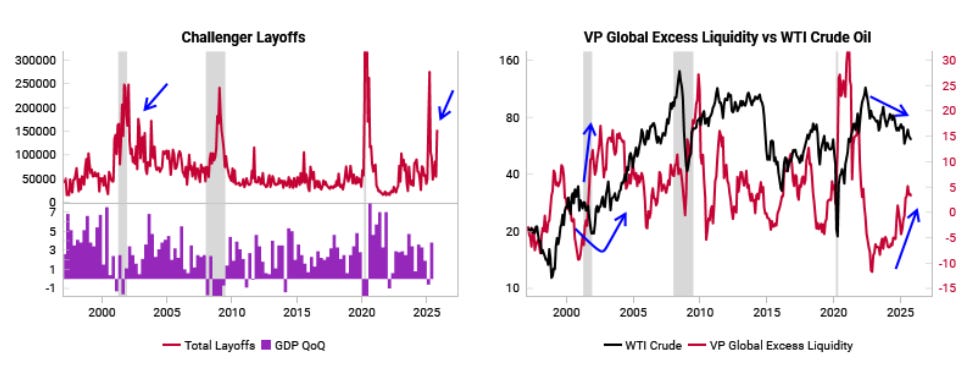

US: Parallels with 2002–03. “Jobless” growth and rising productivity against backdrop of elevated excess liquidity and Fed easing.

China: Growth LEIs and liquidity losing momentum. More stimulus needed for housing/consumer sectors.

Eurozone: We struggle to get too excited about growth LEIs recovery given structural problems. Still like short EURUSD.

Notes

US Growth: Still resilient

US Inflation: Moderate inflation pressures, Fed can focus on labor market

US 2002-03 Analog: “Jobless” growth, rising labor productivity and excess liquidity

US Manufacturing: Lower yields, lower oil, and lower USD are manufacturing tailwinds

China: Growth leading indicator rolling over

China: Liquidity tailwinds slowing, more housing/consumer stimulus needed

Eurozone: Improvements in growth leading indicators continue

Eurozone: Inflation outlook mixed, weaker euro still playing out