US Small Caps: From UW to Neutral on Macro Tailwinds

Weekly Wrap, Sep 26, 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

Research

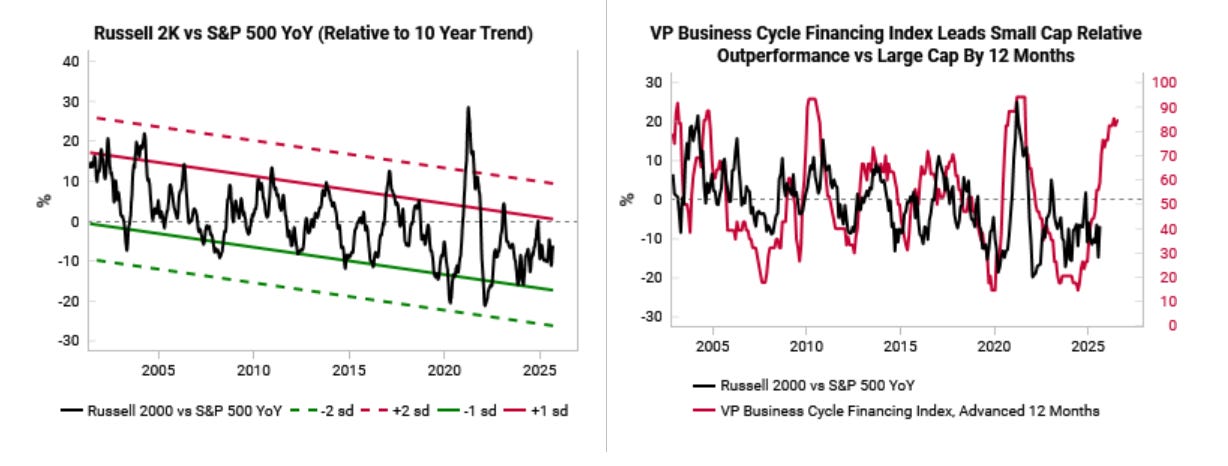

US Small Caps: From UW to neutral on macro tailwinds

We are reversing our long-held bias against US small caps and returning to a neutral outlook.

Periods of synchronized global central bank easing have historically led to a more reflationary environment, resulting in small cap outperformance.

Macro tailwinds and inflows are likely to be meaningful drivers of small cap outperformance, but the structural quality problems remain.

Buy the rumor, sell the fact into Fed + global macro updates

Take profits on our long SOFR, while retaining a long USD bias into next week.

Add long USDKRW as our preferred long USD exposure alongside short EURUSD.

Close our short CNHKRW for flat and stop out of short AUDUSD.

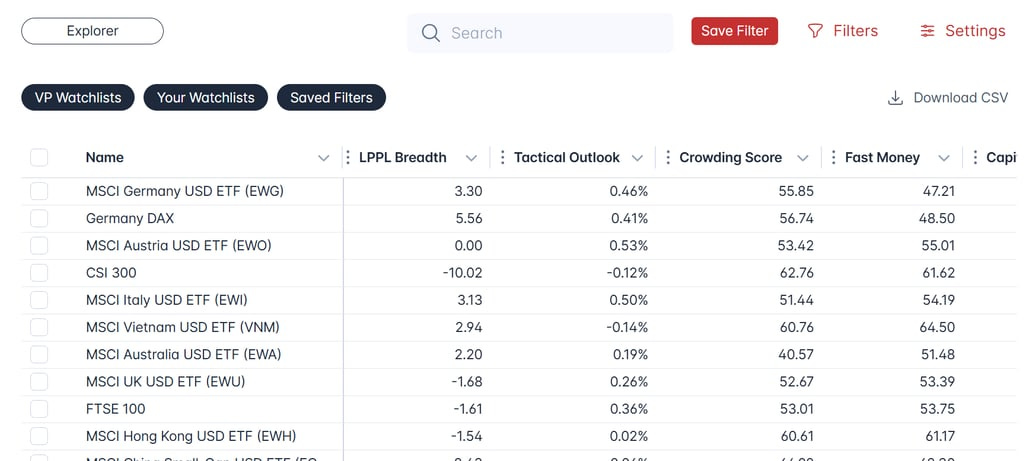

Our New Asset Explorer

Search and filter across all major asset classes (equities, single stocks, fixed income, commodities, crypto, and more).

Select multiple assets to compare and chart with our proprietary models and scores.

Build and monitor your own personalized watchlist.

Create custom scores to filter with.