Volatility forest fires yet to burn

The below is an excerpt from our Nov 22nd report to VP clients.

One of the interesting features of this year’s bear market has been the strong performance of short AND long vol strategies.

Short vol strategies have worked this year as the VIX curve has mostly been in contango (positive roll effect from selling longer-term VIX futures and buying shorter-term futures) and VIX has not spiked above 36.

We think forest fires offer a great analogy for thinking about volatility. Structural drivers of volatility tell us when the forest is most at risk and tactical drivers of volatility provide the sparks that light the fire (see our previous blog post: Understanding Volatility).

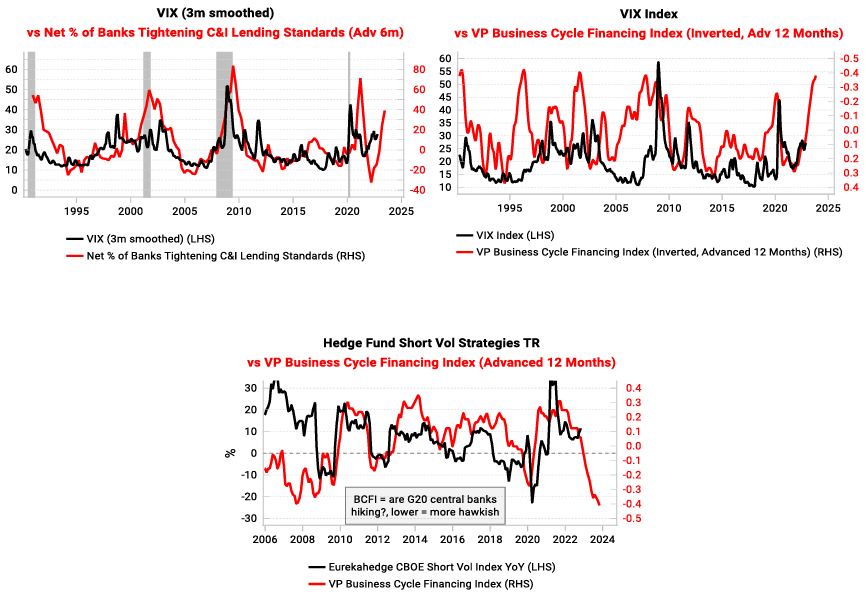

The credit and liquidity cycles offer long leads on volatility. Extreme abundance of liquidity (e.g. 2020-21) lead to surges in credit and debt. As liquidity tightens and credit cycles mature, much of the previously extended credit cannot be repaid, leading to charge-offs and bankruptcies and spikes in volatility.

There is clear evidence the credit cycle has turned sharply lower in the US (left-hand chart; red line higher = banks are tightening lending standards). Liquidity indicators confirm a much higher chance of a vol spike (right-hand chart). Short vol strategies remain very vulnerable in this environment.

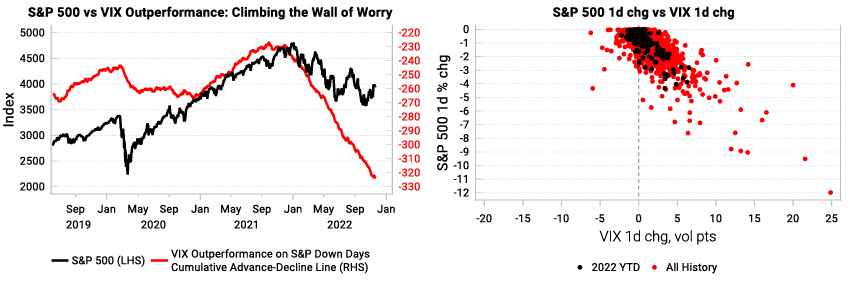

Tactical drivers of volatility have not aligned with structural drivers this year. The VIX index has consistently underperformed the S&P (left-hand chart shows our cumulative advance-decline of VIX outperformance vs the S&P daily move).

This is not just a US phenomenon, the VSTOXX index has also underperformed on down days this year.

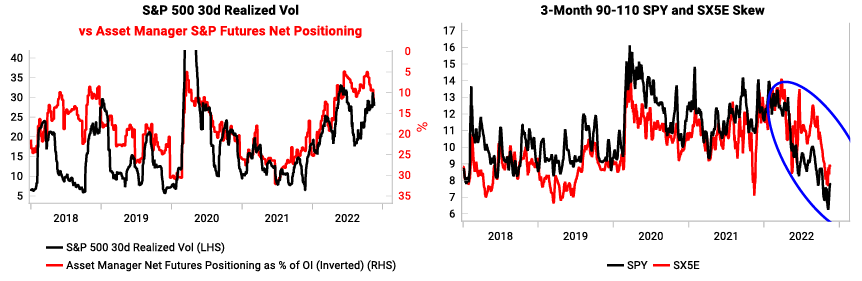

Depressed equity positioning is one of the key drivers of vol underperformance. Vol target funds aim to maintain a stable rate of realized volatility by trading equity futures. When realized vol shifts lower, these funds lever up equity exposure and buy index skew. But this year has seen these funds reduce equity positioning (red line inverted), as index skew collapses.

This is largely why S&P put spreads have been inefficient hedges this year.

Get the full picture at variantperception.com