This is an excerpt from our August 17th report to VP clients (link to the original report), showcasing our framework to tie together structural long-term themes with short-term macro themes. In particular, utilizing the capital cycle to identify Japanese insurers as the asymmetric way to play the BoJ.

Heightened Cyclical Inflation Pressure in Japan

Our Japan inflation LEIs have highlighted persistent cyclical inflation pressures, driven by renewed JPY weakness and elevated price surveys.

Japan's Labor Market Remains Very Strong

Japan's labor market leading indicators also continued to show strength.

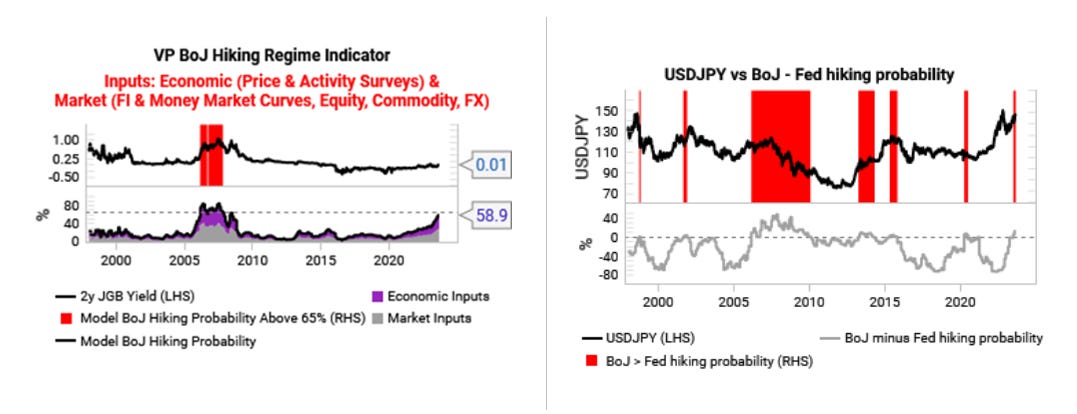

BoJ Hiking Model Heading Higher

The combination of rising inflation and robust labor market data triggered our BoJ hiking regime model. While this model was built as a real-time timing tool, the BoJ’s ongoing yield curve control (YCC) required a more nuanced interpretation. The BoJ is trapped in its impossible trinity problem unless they abandon YCC.

Japan's Life Insurers: The Asymmetric Play

Our longer-term work on capital cycles had previously identified Japanese insurance as capital-scarce back in September 2022 (link). The sector was hated at the time due to Japan’s perennially low yields and was an obvious beneficiary from a higher rate regime in Japan.

In the August 17th update, our crowding scores also flagged that the sector and single names were noticeably uncrowded (i.e. hated).

Snapshot of Japan Post crowding score on August 17th:

Snapshot of Dai-Ichi Life crowding score on August 17th:

Throughout 2022, Japan's lifers emerged as significant net sellers of foreign bonds, redirecting funds back to Japan.

Given the 3-4% dividend yield on offer in the equity, investing in Japan's lifers presented an attractive carry trade waiting for the insurance capital cycle to play out in a higher-rate regime.

This investment offered better carry but also stood out as a more strategic investment compared to the negative carry seen in shorting USDJPY or the crowded short JGB trade.

Snapshot of the rallies seen in Japan Post & Dai-Ichi Life Holdings since August 17th:

For more insights into our investment framework, visit

wow, great call there

Thanks for the comment Andy.